Understanding Medicare enrollment & coverage What plan makes the most sense for you? Find out. Overview by Tim Lonergan, CFP®, CPWA®, Senior Financial Planner

Overview by Tim Lonergan, CFP®, CPWA®, Senior Financial Planner

Updated on November 12, 2024

In the U.S., the topic of Medicare has near-universal appeal, as it affects nearly everyone. At the same time, it is a subject that can be exceedingly complicated and nuanced. There is no “one-size-fits-all” solution; rather, your Medicare choices require serious thought and careful consideration. There is often confusion about where to turn for answers – and even with the right information in hand, it isn’t always clear which claiming strategy may be best for your situation.

With this in mind, Westmount’s Planning Team hosted a webinar to help clients navigate the many options associated with Medicare enrollment. You can watch the replay, featuring Senior Financial Planner Tim Lonergan, below:

The following information is covered in the video above.

The following information is covered in the video above.

What is Medicare?

Most of us are familiar with Medicare at a high level. Quite simply, Medicare is the federal health insurance program for those who are 65 or older, and other individuals who are experiencing disabilities or end-stage renal disease. Most often, Medicare replaces our employer-based coverage throughout our retirement years.

How do you enroll in Medicare?

When you are eligible for Medicare, you can generally enroll in one of two ways.

The first method is automatic enrollment. Automatic enrollment is most common for those who are already receiving Social Security benefits – either by claiming your retirement benefits by age 65, or by receiving Social Security Disability Income for at least the past 24 months.

If you do not qualify for automatic enrollment, you will need to enroll manually. You can do so through the medicare.gov online portal or by calling 1-800-MEDICARE. The sign-up process can be completed during any of the three enrollment periods: initial enrollment, general enrollment, or special enrollment.

The Initial Enrollment Period

The initial enrollment period spans a 7-month window coinciding with your 65th birthday. This period begins 3 months before your 65th birthday and ends 3 months after. The start date of your coverage, however, depends on when during this period you sign up.

For example, if you sign up before your 65th birthday, coverage will begin the month you turn 65. If you sign up the month of or after your 65th birthday, coverage will begin the following month. With this in mind, it is vital to ensure you are enrolling in a timely manner. Please note that if you miss your initial enrollment period without a qualified exemption, you may face penalties down the line.

The General Enrollment Period

The general enrollment period runs from Jan. 1 thru March 31 each year. This is the time when you can enroll in traditional Medicare if you missed your initial or special enrollment period. For this period, coverage begins the month after you enroll.

As mentioned previously, you may incur penalties if you miss the initial or special enrollment periods. For example, the Part B late enrollment penalty is 10% for each year you could have signed up for Part B, but did not. This is not a one-time penalty; rather, it follows you for life.

For example, if you are late to enroll by 24 months, you could face a 20% Part B Premium penalty in perpetuity. In addition to the Part B penalty, you may also be subject to a Part D penalty, and some beneficiaries may even experience a Part A penalty as well. This shows how important it is to sign up for Medicare in a timely manner!

The Special Enrollment Period

The last enrollment period is the special enrollment period. This period allows you to sign up for Medicare after your initial eligibility without facing any penalties.

This is most commonly relevant for those who maintain qualifying employer-based coverage beyond age 65. There are a few requirements to be deemed as qualifying coverage, one of which is the size of your employer. Your employer must have 20 or more employees to be deemed qualified. If you are unsure of your employer’s status, you can check with your benefits department to assess eligibility. Please note that COBRA coverage from a qualified employer does not count. This special enrollment period ends eight months after your coverage lapses, which differs from the timeline of an initial enrollment period.

It is important to note that this is just one example of a special enrollment period. There are other triggers that may be relevant to your situation. For instance, current beneficiaries may enter a special enrollment period if they move to a new address that is not in their current plan’s service area.

What are the different parts of Medicare?

So far, we have covered the basics of Medicare, as well as how and when to enroll. Next, we will walk through the various parts of Medicare, what they cover, and what they cost.

Traditional Medicare

Medicare can generally be broken down into two categories. The first category, Traditional Medicare, can be thought of as the coverage you receive as a result of your payroll contributions over your working years.

Traditional Medicare has two parts: Part A and Part B. Part A is designed to cover inpatient care, as well as limited skilled nursing care, home health care, and hospice. Part B, on the other hand, will cover most of your outpatient types of services. This may include preventive care, outpatient procedures, diagnostic tests, and durable medical equipment.

Medicare Part A

Most beneficiaries, but not all, receive Medicare Part A coverage premium-free. Generally, you are eligible for premium-free Part A if you or your spouse have paid Medicare taxes for at least 10 years. If you are not eligible for premium-free Part A, you can still obtain coverage but will face varied premium costs based on the duration of time you have paid Medicare taxes. For the purposes of this piece, we will assume any hypothetical beneficiaries have worked the necessary 40 calendar quarters.

While it is premium-free for most individuals, there is still cost-sharing associated with Part A. In 2025, there is a $1,676 deductible per benefit period. A benefit period is defined as the period of time you are receiving inpatient or skilled nursing care. A benefit period begins the day you are admitted and ends when you have gone 60 consecutive days without additional care. This means that it is possible to have multiple benefit periods, and therefore multiple deductibles, in any given year.

In addition to your deductible, you may be responsible for coinsurance depending on the length of treatment you receive in an inpatient or skilled nursing facility. Cost-sharing can rise, and is theoretically uncapped, depending on the nature and duration of your stay.

Medicare Part B

Medicare Part B also comes with its own cost-sharing structure. The 2025 annual deductible, for example, starts at $257. This differs from the Part A deductible, as it is assessed on a calendar year basis rather than per benefit period.

Additionally, Medicare Part B comes with a monthly premium. The base premium is currently $185. It is important to note that the Part B premium, and Medicare costs in general, are adjusted annually.

The mechanics of paying the premium depend on whether or not you are collecting Social Security benefits. If you are receiving Social Security benefits, your Part B premium will be automatically deducted from your benefit payment. However, if you have not claimed your retirement benefits yet, you will need to manually pay your premium directly with Medicare. Details of this process, as well as the payment methods, can be found on Medicare.gov. Lastly, and most importantly, there is a 20% coinsurance requirement for Part B services with no out-of-pocket maximum.

Medicare Part D

Now that we have covered Traditional Medicare, you may have noticed that there was no reference to prescription drug coverage. That is where Part D comes in.

Part D is slightly different from Parts A & B, as you have to enroll separately for this standalone coverage. Part D plans are offered through private insurers, and you can enroll during your initial enrollment period or the annual open enrollment period.

Premiums for Part D coverage can vary wildly, but the national average for monthly premiums falls in the range of $30 to $40 per month. In addition to your premiums, you may be subject to cost-sharing depending on which phase of coverage you are in. The amount of coinsurance or copayment will depend on the specific drug tier within the plan formulary.

In 2025, once your out-of-pocket spending reaches $2,000, you will no longer be subject to copayment or coinsurance for covered Part D drugs. You remain in the catastrophic coverage phase until it resets in the next calendar year.

It is important to note that each part D plan has different coverage tiers and formularies, which can change annually. This reinforces the importance of shopping plans every year to ensure you are receiving the most appropriate coverage based on your individual needs.

Medicare IRMAA

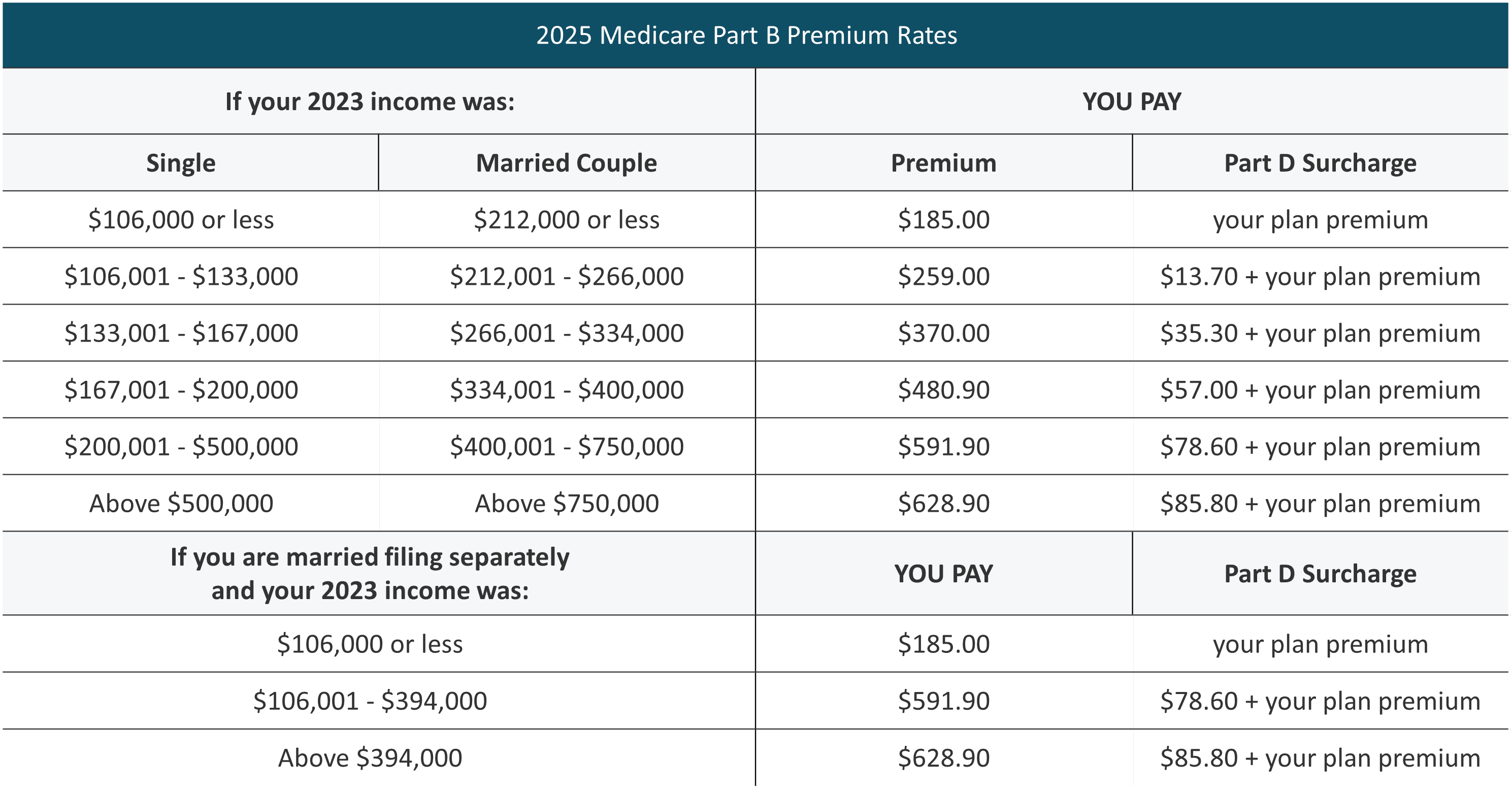

One thing that Part B and Part D coverages do have in common is their potential for IRMAA adjustments. IRMAA is the acronym for Income Related Monthly Adjustment Amounts. At its core, IRMAA is a surcharge attached to Part B and Part D premiums for higher-income taxpayers.

To determine your income for IRMAA purposes, you would utilize your Modified Adjusted Gross Income from 2 years prior. In the case of 2025, you would utilize your 2023 MAGI. Modified Adjusted Gross Income is defined as your Adjusted Gross Income with certain addbacks, such as tax-exempt interest, for example.

If you have experienced a life-changing event that has drastically changed your income profile, you do have the ability to appeal your IRMAA decision directly with Medicare. This process can be completed by filling out form SSA-44, which can be found on SSA.gov. Like traditional base Medicare costs, the IRMAA amounts and income thresholds are adjusted annually. It is important to assess projected annual income in order to have a clear picture of any potential IRMAA adjustments down the line.

Medigap and Medicare Advantage

In addition to Traditional Medicare and Part D, there are also supplemental plans, which are a vital component of one’s overall healthcare planning strategy. According to the Kaiser Family Foundation, approximately 92% of the 65 million Medicare beneficiaries couple their traditional coverage with supplemental policies. Most often, those supplements take the form of Medigap or Medicare Advantage.

Medigap

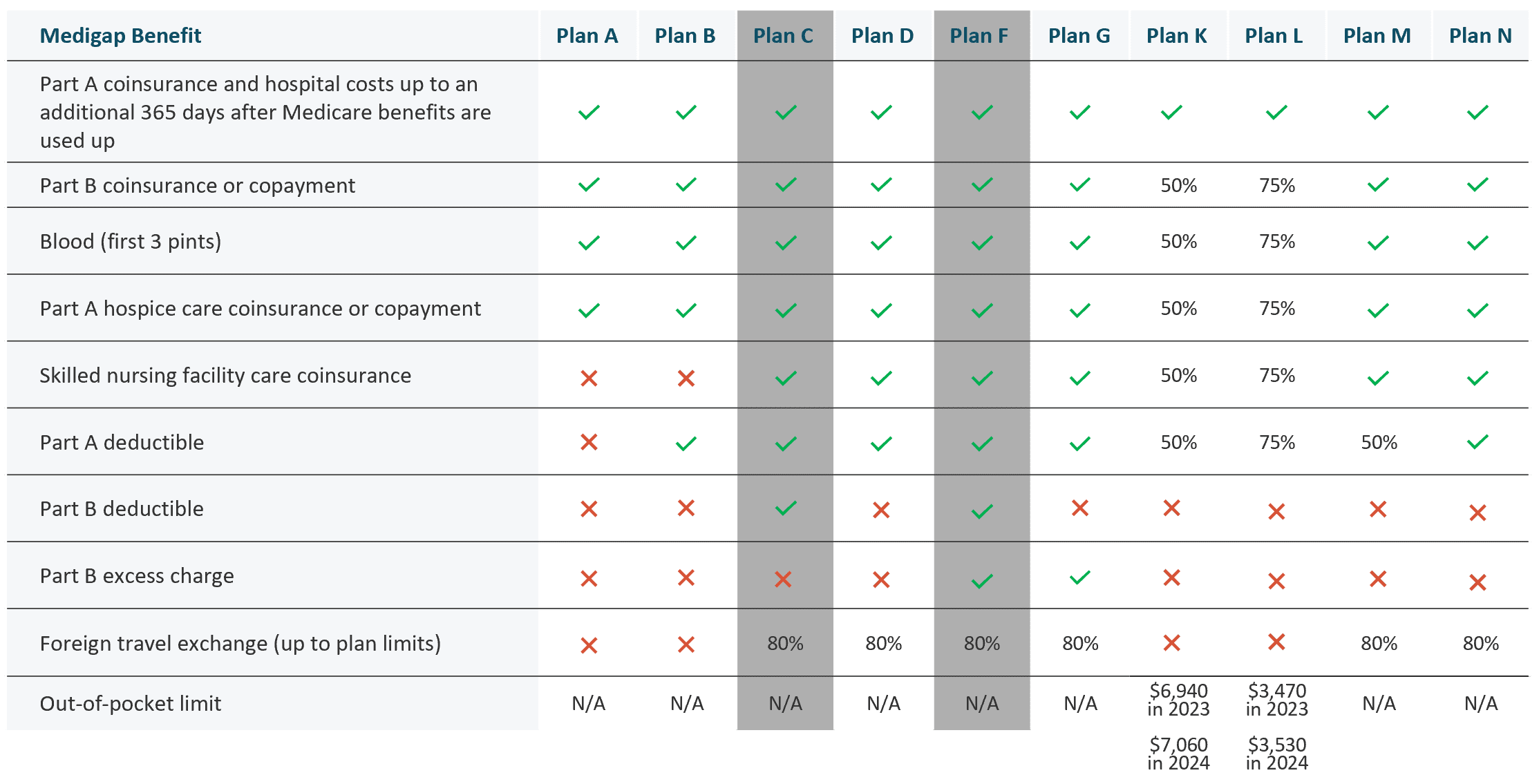

Medigap, or Medicare Supplemental Insurance, is a policy that you purchase through a private insurer to fill in the gaps of original Medicare. Medigap plans are standardized and have options ranging from Plan A to Plan N. Although using the same standardized naming mechanism, Medicare Plan A and Medigap Plan A are different programs. Across Plan A to Plan N, we can expect similarities in coverage; however, there may be a differential in cost.

Please note that Plan C and Plan F are no longer available to new beneficiaries, which means that Plan G currently provides the most comprehensive coverage. You may still be eligible for Plan C or F if you were eligible for Medicare prior to January 1st, 2020, but new beneficiaries cannot obtain this coverage.

The Medigap policy fills in the gaps by directly covering some of the cost-sharing requirements in your Traditional Medicare policy. For example, the 20% Part B coinsurance or copayment is covered at some level in all Medigap policies. Medigap plans are accepted by any healthcare provider who accepts Medicare. When you sign up for Medigap during your initial enrollment period, that is known as a guaranteed issue period – meaning you cannot be denied coverage. If you attempt to switch into or between Medigap plans outside of that window, you may be subject to increased rates or denial based on underwriting.

While everyone has a guaranteed issue period during qualified initial enrollment, certain states provide alternate windows in which you can enjoy the same protections at different times. It is also important to note that Medigap plans do not include Part D coverage.

Medicare Advantage

Medicare Advantage is similar in that it offers supplemental coverage, but it operates very differently than Medigap. Often referred to as Part C plans, or “all-in-one” plans, Medicare Advantage plans are bundled offerings provided by private insurers. These plans can include components such as Part A and B coverages, Part D coverage, dental insurance, hearing and vision, and other fringe benefits. Unlike Medigap, these plans often function more similarly to HMO or PPO plans, meaning you may be subject to networks and preapprovals. Plan coverages and premiums can vary wildly, so it is essential to shop around when you initially enroll, as well as during the annual open enrollment period.

Medigap or Medicare Advantage: Which one is right for you?

Deciding whether Medigap or Medicare Advantage is right for you is highly dependent on your individual circumstances. For instance, are you comfortable with networks? Do you spend time in different states throughout the year and therefore require broader service? How much do you value lower premiums? Would you prefer to limit your potential out-of-pocket exposure if you were to get sick? There are many different nuances that should be considered when making that decision at initial enrollment.

Medicare After Initial Enrollment

After that initial enrollment, Medicare beneficiaries should not put everything on autopilot. Reassess your coverage during the annual open enrollment period to ensure it is still suiting your needs. As you can see, coverage levels and amounts frequently change, so it is extremely important to stay abreast of those changes and how they may impact your specific situation.

Medicare Open Enrollment

At the time of reading this, you may be in the midst of an open enrollment period. This annual period runs from Oct. 15 thru Dec. 7. During this window, you can reassess your Medicare health plan or prescription drug plan to ensure it is still meeting your needs. This is a great time to shop around, and there is significant value in doing so even if you believe there are no changes warranted to your coverage.

If you end up making a change, your new coverage will be effective Jan. 1 following the open enrollment period. In addition to the annual open enrollment period, there is also an additional Medicare Advantage Open Enrollment Period from Jan. 1 to March 31, if that is applicable to you.

Medicare Resources

While we covered a significant amount of ground in this overview, we have only scratched the surface. Medicare is very nuanced and proper planning is vital. For more questions on Medicare and coverages, visit:

For additional questions, we encourage you to reach out to your Westmount advisor or contact us at info@westmount.com or 310-556-2502.

Recent posts

Sources

CMS | Lower Out-of-Pocket Drug Costs in 2024 and 2025

Medicare | Costs in the Coverage Gap

1Medicare Costs

2Medigap Policies Chart

Disclosures

This document was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission. Westmount believes the sources used in this document are reliable, but Westmount does not guarantee their accuracy. The information contained herein reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update the contents of this document. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this document may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent.