Market insights: it’s all in the earnings How is it possible for the global stock market to be up over 11% given the backdrop of the pandemic? Analysis by Terrence Demorest, Chief Investment Officer - Public Markets and ESG

Analysis by Terrence Demorest, Chief Investment Officer - Public Markets and ESG

Many investors are wondering how it’s possible for the global stock market to be up over 11% given the backdrop of the ongoing pandemic. Above all else, financial markets tend to trade based off of future expectations—and therein lies the answer.

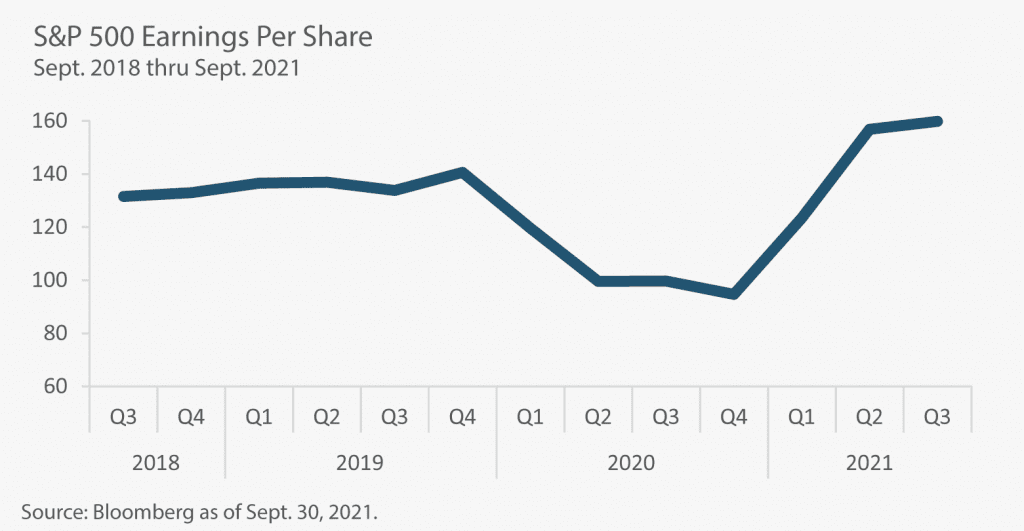

Looking back at March/April of 2020 when the pandemic first started, corporate earnings estimates were immediately slashed to the downside, in some cases quite severely. The global stock markets responded by falling over -33%. By May, though, when the next earnings cycle began, 80% of all companies in the S&P 500 beat their revised earnings estimates by a whopping +19%. That trend has continued each quarter for the past year and a half as corporate earnings continue to outperform market expectations. Refer to the chart below:

While unexpected outside events can influence market movements over the short-term, and stock market volatility has not gone away, long-term markets track corporate earnings. While there were market segments that deserved to trade down at the beginning of the pandemic (retail and hospitality) we continue to be optimistic long-term as corporate profits remain very strong.

More Quarter Notes

Year-End Planning Amid Tax Law Uncertainty: What Should You Do Now?

Protecting Your Assets From Cyberfraud

Westmount is a Top Independent Financial Advisor for 2021

Jim Berliner Named a Leader of Influence for 2021

Adding New Talent to Our Team

If you have any comments or questions about this article, please contact us at info@westmount.com.

Recent posts

Disclosures

This article was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission. The information contained in this article was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this article may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent.