Understanding portability in today’s high exemption era Interview with Felicia Chang, Head of Wealth Strategy

Interview with Felicia Chang, Head of Wealth Strategy

We are living in an era of historically high estate, gift, and generation-skipping transfer tax exemptions. From an estate planning perspective, it is more important than ever to explore every available planning opportunity to preserve family wealth. An often overlooked but valuable tool is the ability to preserve the unused estate tax exemption upon the death of one spouse. This unused portion can be transferred to the surviving spouse through a provision known as “portability.”

The notion of portability isn’t new, but it has taken on greater importance in light of the federal estate, gift, and generation-skipping transfer tax exemption amounts made permanent by the “One Big Beautiful Bill Act” (OBBBA) passed earlier this year. OBBBA permanently set the federal estate, gift, and generation-skipping transfer tax exemptions to $15 million per individual (inflation-adjusted annually) starting Jan. 1, 2026 (for married couples, the exemption amount is $30 million).

Prior to 2011, if a deceased spouse died without using their entire estate tax exemption, the unused exemption would be lost. In 2011, federal tax law changed to allow the transfer of a deceased spouse’s unused estate tax exemption to the surviving spouse.

Under current portability rules, the survivor may use the exemption “inherited” from the first spouse for lifetime gifts or to reduce or eliminate estate taxes at the survivor’s death. For many married couples, portability has become a very useful tool by providing flexibility to protect more of a family’s wealth without relying on complex trust structures.

We spoke with our Head of Wealth Strategy, Felicia Chang, to learn more about portability and the ways our clients can potentially benefit from this technique.

Felicia, how does portability work?

When a person dies, if the value of their taxable estate is less than their available estate tax exemption, the unused portion can be preserved and transferred to the surviving spouse. This is the Deceased Spousal Unused Exclusion (DSUE) that can be added to the surviving spouse’s own estate and gift tax exemption. If portability is elected, the DSUE amount is automatically applied first to any lifetime gifts made by the survivor before their own gift tax exemption is used.

What are the requirements for portability?

Portability is not automatic, and a few conditions must be met. First, the deceased spouse’s executor must timely file a federal estate tax return (Form 706) to affirmatively elect portability.

Generally, filing a Form 706 is required only if the decedent’s estate exceeds the federal estate tax exclusion amount. The filing deadline is nine months (with a 6-month extension) from the date of death. However, to elect portability, filing the Form 706 is required even if the estate is below the filing threshold. For smaller estates below that threshold, Form 706 must be filed within five years of the decedent’s date of death. Failure to elect portability or properly file Form 706 before the deadline might result in losing the DSUE forever.

The decedent must also have been a U.S. citizen or resident who is survived by a spouse, and the decedent must have died after December 31, 2010.

What should people know about DSUE, the Deceased Spousal Unused Exclusion?

While electing portability may yield significant future estate tax savings, it has some potential drawbacks that people should keep in mind.

- To elect portability, a Form 706 must be filed. This can be expensive, time-consuming, and administratively burdensome – especially for estates well below the filing threshold.

- Unlike the estate tax exemption, DSUE is not indexed for inflation. This can be especially impactful if many years pass between the first and second spouse’s deaths. During this period, asset values may appreciate significantly while the DSUE stays fixed. As a result, the surviving spouse may end up with a larger taxable estate and potentially owe estate taxes. In contrast, assets held in a bypass/exemption trust are not subject to estate tax at the survivor’s death, regardless of the amount of appreciation.

- Portability is not available to preserve the deceased spouse’s unused generation-skipping transfer (GST) tax exemption. Families wishing to use GST planning to create multigenerational or dynasty trusts generally cannot rely on portability to secure GST benefits.

- DSUE can be lost if the surviving spouse remarries. A surviving spouse who remarries can use the DSUE from a prior deceased spouse, provided the new spouse is still living. If the new spouse dies, the original DSUE is replaced by the new spouse’s DSUE.

This is not an exhaustive list of all the potential downsides of electing portability. However, it serves as a reminder that there is no such thing as a perfect plan or strategy. All the advantages and disadvantages of any planning option should be considered and discussed with your planning team to minimize any undesirable outcomes in the future.

Can you walk us through some examples?

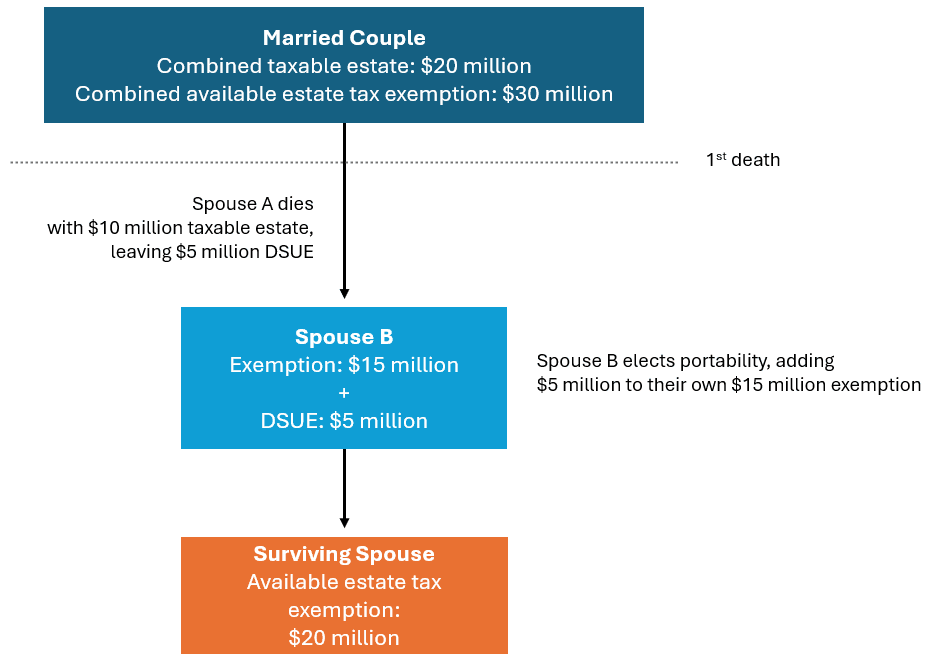

Let’s assume a married couple has a combined net worth of $20 million and the first spouse dies in 2026. The deceased spouse’s taxable estate is valued at $10 million, and the estate tax exclusion amount in 2026 is $15 million. The DSUE, therefore, would be $5 million ($15 million – $10 million). That amount can then be transferred to the surviving spouse, who elects portability on a timely filed estate tax return.

If the surviving spouse makes no taxable gifts, does not remarry, and dies later in 2026, they would be able to shelter $20 million of assets from estate tax ($15 million + $5 million DSUE). At the survivor’s death, they would have a $5 million DSUE in addition to their own estate tax exemption, effectively giving them extra exemption. This combined exemption can significantly reduce or eliminate federal estate tax liability on the second death, allowing more assets to pass to their children.

If the surviving spouse made taxable gifts during their lifetime, the DSUE is applied first before using the survivor’s own exemption. For example, if the survivor made lifetime gifts totaling $5 million, there would be no DSUE remaining at their death (assuming no remarriage). However, the surviving spouse would still have their own $15 million estate tax exemption, even after transferring $5 million tax-free to their beneficiaries during their lifetime.

What if a surviving spouse remarries and the new spouse dies before the surviving spouse?

In that scenario, the surviving spouse can only use the DSUE from the second spouse who died. If that second spouse was a wealthier spouse with a large taxable estate that used their entire estate tax exemption, the surviving spouse would lose the DSUE from the first spouse and have only their own estate tax exemption at death.

Can portability and the higher estate tax exemption reduce my need for traditional subtrusts like bypass/exemption trusts?

It depends. If your primary goal is estate tax minimization only and you are not concerned with remarriage risks or GST planning, then yes, the higher estate tax exemption and portability may reduce your need for subtrusts. Because portability allows the surviving spouse to save DSUE, a bypass/exemption trust is not needed for the sole purpose of preserving the deceased spouse’s exemption.

With historically high exemptions, many families fall well below the threshold even without using a bypass/exemption trust. Portability provides many families the option to simplify their estate plan without the mandatory subtrust division that is standard in many estate plans.

Additionally, income tax considerations should be part of the analysis. Unlike property held in bypass/exemption trusts that do not receive a basis adjustment when the survivor dies, assets held in a surviving spouse’s estate receive a basis adjustment at the second death. The combined basis adjustment and DSUE can create a double benefit for the heirs by minimizing both capital gains and estate taxes.

However, if you have additional family objectives beyond estate-tax minimization, such as preserving assets, GST planning for future generations, asset protection for the surviving spouse, or control over where assets ultimately pass, for example—subtrust planning may be a better option.

It is important to understand all of your options and weigh them against your planning priorities and goals. Our planning team can be a valuable resource in these discussions and partner with your tax and legal advisors.

Do you have any closing guidance?

Portability can be a powerful tool for preserving a couple’s full estate tax exemption while keeping their planning straightforward and flexible. By electing DSUE at the first spouse’s death, families can protect more assets from estate tax and maintain the opportunity for a basis step-up at the second death.

However, because every family’s situation is unique, portability may not always be the best option. As with any major financial decision, please consult your Westmount Advisor, who can review your situation in more detail and provide guidance about your estate planning goals.

Recent posts

Sources

Copy by Katherine Doyle

Disclosures

This content was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this content was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this content may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent. Past performance is not an indication of future results. If you have any comments or questions about this content, please contact us at info@westmount.com.