The evolution of our high-income strategy A look at decades of investing in alternatives Update by Terrence Demorest, Chief Investment Officer – Public Markets and ESG

Update by Terrence Demorest, Chief Investment Officer – Public Markets and ESG

Westmount has been allocating portions of client portfolios to alternative assets—that is, asset classes and strategies that are alternatives to traditional stocks and bonds—for over three decades. During that time, we have invested in diverse fields like real estate, natural resources, hedge funds, and merger arbitrage, to name a few.

The current focus of this portion of our client portfolios—private credit (also sometimes called “private lending”)—originated in 2020, just as the global pandemic was starting to unfold. At that time, interest rates were already low before the Federal Reserve Bank essentially took them to zero in order to stabilize and stimulate the economy amidst tremendous uncertainty. This made traditional bonds extremely unattractive to us, since they generated little income and stood to fall in price when interest rates eventually rose again.

For that reason, we sought to reallocate some of our clients’ bond exposures into investments that would provide much higher income without taking on excessive risk. This led us to the private credit market, which we had been researching extensively and had even begun to dip our toes into just as the pandemic emerged.

Private credit consists of private corporate and real estate loans that are backed by tangible assets as collateral. These loans tend to be short-term, and interest rates on the loans typically float with market changes (providing better protection for the loan values when interest rates rise, in sharp contrast to traditional fixed-rate bonds).

Back in 2020, though, private credit was a challenging asset class to access due to many barriers to entry. For one, the underlying loans are private and can’t be liquidated as easily as publicly traded bonds, so funds investing in this market have fewer quarterly liquidity opportunities.

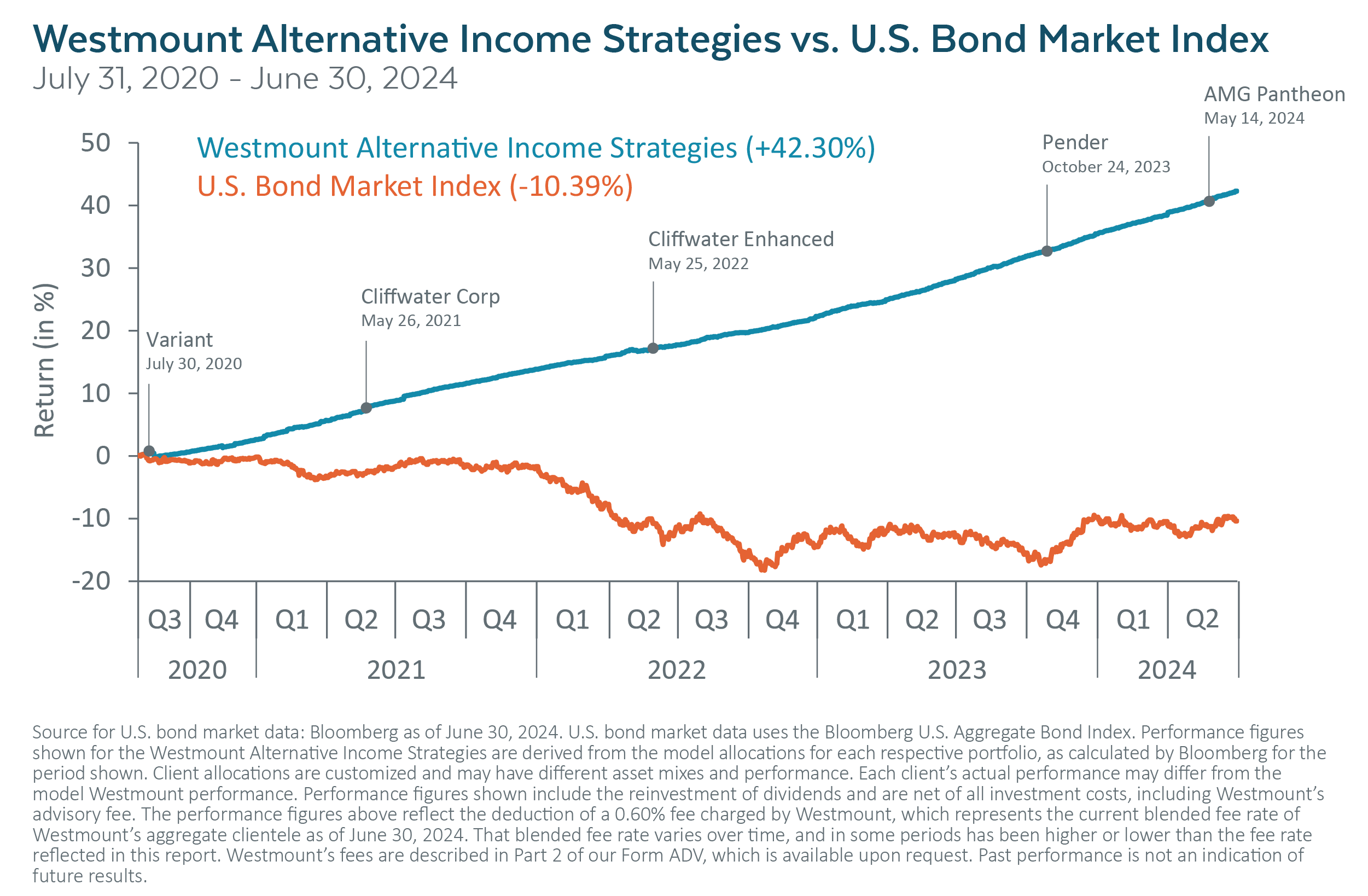

At that time, only a few managers offered investment vehicles that were accessible to advisors and their clients. Fortunately, our extensive research and relationships led us to an attractive investment vehicle, and in July 2020, we made a meaningful commitment to one of the first funds in the industry: the Variant Alternative Income Fund (NICHX). This fund provides access to a diverse mix of high-income-generating assets, such as trade finance, litigation finance, and royalties.

Early entry into most emerging investment sectors has the potential to be highly advantageous, since the market is less competitive and managers can deploy their capital much more successfully. For example, when we first invested in the Variant fund, it only had about $478 million in assets, compared to the $2.9 billion it manages today.

This was the case, too, when we purchased the Cliffwater Corporate Lending Fund (CCLFX) less than a year later. While slightly larger than Variant at the time ($1.7 billion), the Cliffwater fund has become the flagship fund in the industry in terms of both performance and asset size (currently $20.2 billion). The Cliffwater fund invests in a highly diverse portfolio of corporate loans, being the borrowers’ senior (most secure) creditor.

As the timeline in the accompanying chart reveals, we have continued to enhance our exposure to private credit. One year after purchasing the Corporate Lending Fund, we added the Cliffwater Enhanced Lending Fund (CELFX) to our core alternatives income model, providing exposure to a wider range of lending segments compared to Cliffwater’s flagship fund. This fund, too, has grown meaningfully (from $610 million at the time we entered it to $3.4 billion today). Because of the size of our firm’s commitment to the newer fund, we also successfully negotiated for the fund to charge no management fees for its first 12 months.

As the timeline in the accompanying chart reveals, we have continued to enhance our exposure to private credit. One year after purchasing the Corporate Lending Fund, we added the Cliffwater Enhanced Lending Fund (CELFX) to our core alternatives income model, providing exposure to a wider range of lending segments compared to Cliffwater’s flagship fund. This fund, too, has grown meaningfully (from $610 million at the time we entered it to $3.4 billion today). Because of the size of our firm’s commitment to the newer fund, we also successfully negotiated for the fund to charge no management fees for its first 12 months.

Our efforts to diversify our high-income strategy continued in the fall of 2023, when we added the Pender Real Estate Credit Fund (PNDIX). Pender focuses almost exclusively on real estate loans in the residential and storage segments.

Most recently, in May of this year, we were part of a small group of seed investors in the AMG Pantheon Credit Solutions Fund (PCSZX). AMG Pantheon invests in private loans purchased on the secondary market, mainly from institutional investors holding these loans. By providing liquidity to these investors, AMG typically purchases the loans at a meaningful discount to their intrinsic value, potentially allowing for excess returns compared to originating the loans themselves. As seed investors in the fund, Westmount clients will enjoy a lower management fee from AMG in the fund’s first year and a preferential, lower fee (relative to later investors) for the full time they hold the investment.

Over the past four years, as we’ve focused on private credit, and as our commitments have evolved, the portfolio has been characterized by its steadiness and compelling returns. In doing so, it has dramatically outperformed the bond market during this period. We anticipate that its composition will continue to evolve to reflect our ongoing assessment of the field’s upside and downside, and our ability to access talented managers in this space.

Recent posts

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent. Past performance is not an indication of future results.

If you have any comments or questions about this article, please contact us at info@westmount.com.