Tariff concerns fuel stock market volatility in Q1 and early Q2 Bonds and alternative assets hold up well Terrence Demorest, Partner and Chief Investment Officer - Public Markets and ESG

Terrence Demorest, Partner and Chief Investment Officer - Public Markets and ESG

After an exceptional two-year run in U.S. stocks, volatility returned in the first quarter of 2025, prompting a pullback across major U.S. stock indices. Market leadership, which had been concentrated in U.S. large-cap names—particularly within the technology sector—shifted to European equities, driven by growing uncertainty surrounding U.S. economic and political policies.

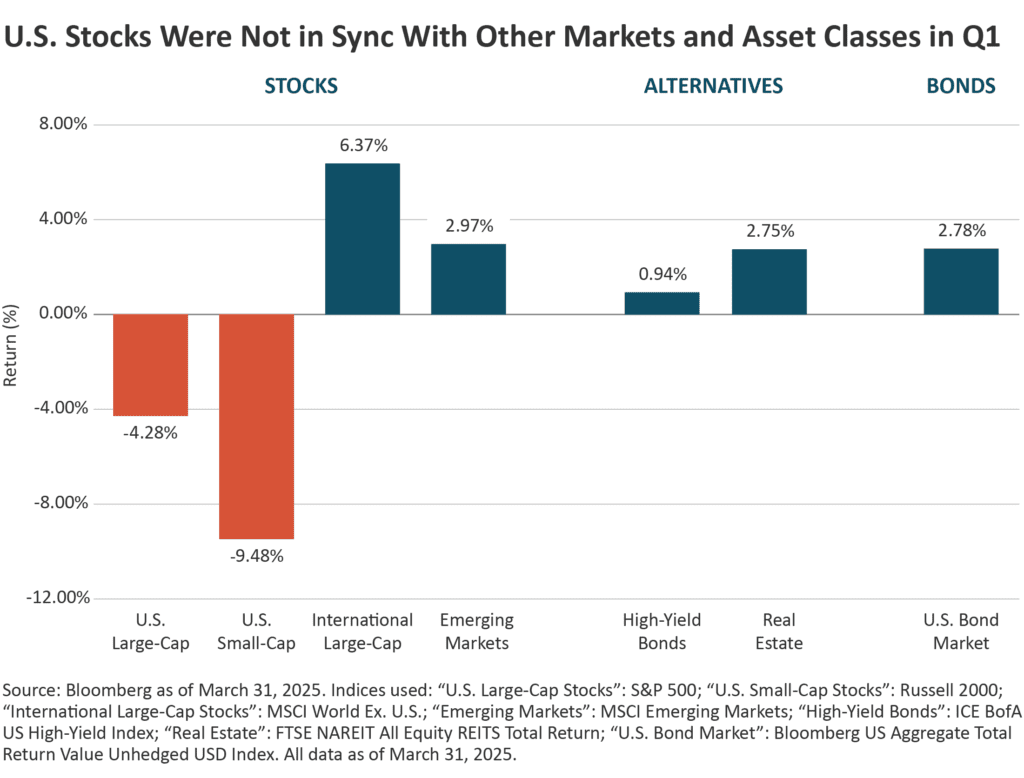

Bond markets, meanwhile, rallied as intermediate and long-term interest rates moved lower, reflecting investor concerns over a potential slowdown and the rising risk of recession later in the year. At the same time, alternative assets posted solid gains, supported by strong fundamentals and continued investor demand for diversified sources of income. (Note that performance for “private credit” is not shown in the chart below because there is a lag in calculating that figure for the leading index. That said, the asset class was positive in Q1.)

Stocks

While tariff threats had been a persistent source of concern throughout the first quarter, it wasn’t until this month that the Trump Administration made its plans clear. The market response was swift and negative, with equities selling off sharply as investors digested the implications for global trade, supply chains, corporate earnings, and inflation. The uncertainty weighed heavily on sentiment worldwide, particularly as the tariffs were expected to significantly impact the U.S., our trading partners, and the broader global economy. Then, the Administration shifted course, pausing large parts of its tariff order and sending stocks soaring (until they reversed course yet again).

Amid broader market uncertainty in Q1, international stocks stood out with a strong performance, finishing the quarter up +6.37%. This solid gain highlights the benefits of diversification, as not all segments of the market moved in lockstep—underscoring how international exposure can provide meaningful upside even during periods of volatility.

We noted above that, for the first time in several years, international equities meaningfully outperformed U.S. stocks. This reversal was fueled by several factors: renewed optimism around a resolution in the Russia-Ukraine conflict, enthusiasm over European defense stocks (independent of the outcome in Ukraine), and growing concerns over stretched valuations—particularly in the U.S. technology sector, which had driven much of the market’s gains in recent years.

While the path forward remains uncertain—and literally changes by the hour—this period has highlighted the benefits of maintaining a globally diversified portfolio and staying disciplined during times of volatility.

Alternative Assets

In more recent years, private credit has become a cornerstone of alternative income portfolios. These investments typically consist of senior secured, floating-rate loans extended to small and mid-sized corporations, as well as to real estate sponsors. Due to its structure and risk profile, private credit tends to deliver higher yields than traditional public fixed-income markets, with current yields in the 8–12% range.

Consistent with previous quarters, private credit has delivered a strong performance in the first quarter of 2025. Beyond its attractive income potential, private credit continues to serve as an effective portfolio diversifier. Its relatively low correlation to public markets helps reduce overall portfolio volatility—an especially valuable trait during periods of market stress, such as the environment that began to unfold in early Q2 2025.

Bonds

Bond prices rose sharply in the first quarter of 2025, leading to a corresponding decline in yields and marking a strong start to the year for fixed-income markets. Treasury bonds led the rally, with the yield on the 10-year U.S. Treasury falling from 4.57% to 4.21% by quarter-end. This momentum continued into early Q2, as news of newly implemented tariffs triggered a “flight to quality,” briefly pushing the 10-year yield below 4% before it reversed course. Treasuries, often viewed as safe-haven assets during periods of uncertainty, benefited from increased demand. The Bloomberg U.S. Aggregate Total Return Index—a broad measure of high-quality U.S. bonds—rose +2.78% for the quarter.

In Q2, though, credit markets experienced heightened volatility amid ongoing economic concerns about tariff-induced inflation and possibly from foreign sellers of Treasuries. Despite the volatility, most bond sectors remain positive year-to-date, even through this month’s stock selloff.

Recent posts

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent. Past performance is not an indication of future results.

If you have any comments or questions about this article, please contact us at info@westmount.com.