Building the case for modern logistics facilities This radical commercial transformation is changing the game. Discussion with Dimitri Krikelas, Chief Investment Officer – Private Markets

Discussion with Dimitri Krikelas, Chief Investment Officer – Private Markets

We are in the middle of a radical commercial transformation as consumers and businesses alike continue to favor online channels over traditional brick-and-mortar experiences. The convenience of conducting most transactions in just a few clicks has not only altered our habits in this regard but also how orders are being handled behind the scenes.

For investors, what’s especially noteworthy is the shift in how products and data are stored and, ultimately, how orders are fulfilled. To keep up with the escalating demands of online customers, businesses are investing in entirely new structures—modern logistics facilities—that combine state-of-the-art technology with flexible infrastructure to facilitate the exchange of products, services, and information more efficiently.

The increasing proliferation of these modern facilities offers investors an attractive opportunity to invest in a high-growth segment within the real estate asset class.

A Shifting Paradigm

E-commerce sales have been steadily climbing for decades—catalyzed by the COVID-19 pandemic, which triggered an unprecedented expansion. In the post-pandemic retail space, for example, safety-minded consumers have shifted their e-commerce spending from mainly luxury goods to also include medicine, hygiene products, and other household necessities. Consequently, overall e-commerce sales skyrocketed past $791 billion in 2020—up a whopping 32.4%1 from just one year prior. And currently, e-commerce is estimated to account for between 14% – 20% of all retail sales2, with penetration rates expected to eclipse 33% by 20323.

Businesses that have adopted online platforms to facilitate these transactions rely on logistics facilities—warehouses, data centers, fulfillment centers, and the like—to keep up with the increased demand. Yet many of the existing facilities are not up to the task. Consider that 82% of existing U.S. warehouses were built before 2000.4 These aging properties lack the requisite floor space, ceiling heights, and loading bays to accommodate automated supply chains and efficient order management—failures that make it difficult for companies to move goods and services within the narrow delivery windows that customers have come to expect.

Retrofitting these legacy assets is cost-prohibitive and impractical given the technological demands involved. On the other hand, modern facilities can be tailored to accommodate more exacting technological requirements, like route planning software, AI, and machine learning algorithms to enhance efficiency and save costs. Logistics automation like forklifts and high-rise racking systems likewise expedite operations. And bigger buildings foster increased inventory storage of buffer stocks to make sure products are readily on hand.

“Running a warehouse involves a lot more than simply loading boxes onto palates these days,” explains Dimitri Krikelas, Westmount’s Chief Investment Officer for Private Markets. “The tenants who rent these facilities include some of the largest retailers in the world, like Amazon, Walmart, Target, and Costco. They have highly sophisticated operational needs that only modern facilities can accommodate—like solar panels to power electric vehicle charging stations, automated sorting and robotic packaging systems, superior HVAC systems, and enhanced safety measures for employees.”

Other design must-haves typically include:

- Enhanced power to accommodate conveyor belts, electric vehicle charging stations, automated technology, and internet connectivity.

- Higher clear heights to maximize cubic storage capacity.

- Roofs that can support heavier units like solar panels and HVAC systems.

- Columns and vertical support beams spaced wide enough apart to enable unimpeded storage and transport of products.

- Floors made with thick concrete slabs that can support high-carrying capacity material handling systems while also allowing robotic automation to maneuver easily.

- Deeper truck courts and more dock doors to promote easy loading and unloading.

- Built-in amenities like gyms, showers, and outdoor picnic spaces to attract and retain staff.

These advancements can translate to higher profit margins compared to their brick-and-mortar counterparts. For example, a pair of blue jeans retailing for $150 in-store might yield a 16% profit margin after factoring in overhead costs like rent and payroll expenditures, whereas a retailer selling the same pair of jeans online might see margins twice as high. For customers, the only real difference is a saved trip to the mall.

Investment Drivers

The modern logistics space represents attractive and sustainable growth prospects over the long term. Not only are logistics assets primed to outperform legacy assets over the next five years5, but a full 2/3 of U.S. logistics suppliers expect to grow their footprint. And once they set up shop, they’re likely to stick around for a while—even with built-in rent escalators. In fact, the vacancy rate in modern facilities currently sits below 4%.6

“There are many growth drivers within the modern logistics facilities space,” says Krikelas. “The growing trend in e-commerce penetration, the shift toward ‘just-in-case’ inventories, near-shoring, booming consumer spending, supply chain optimization, and the focus on modernity to support increasingly complex warehouse management systems are fueling the demand and increase in rents.”

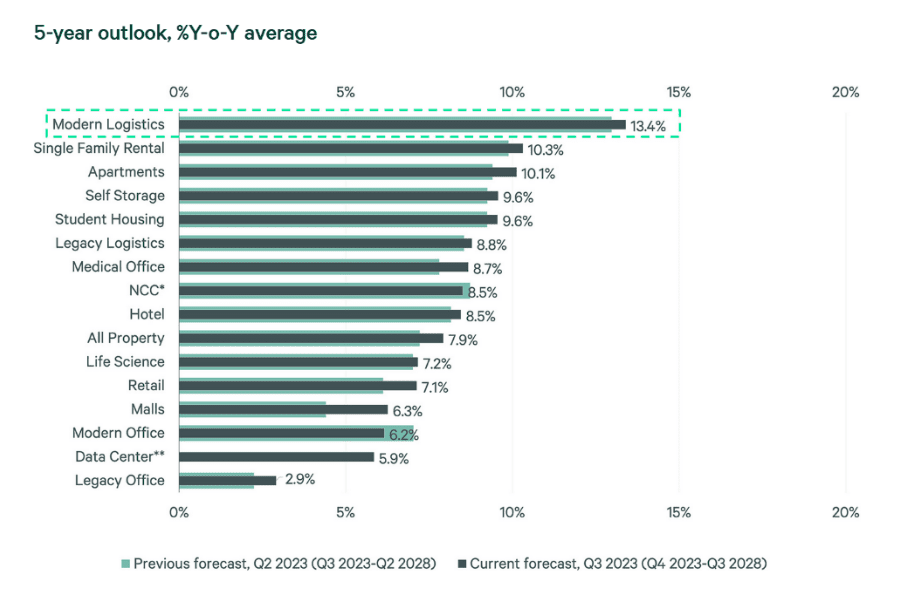

This may benefit investors because, over the next five years, rental growth in the space is projected to surpass 13%—handily outpacing other commercial real estate silos like storage units, medical offices, retail establishments, and shopping malls.7

“Plus,” adds Krikelas, “we believe that massive rent growth is expected to further increase net operating income (NOI) growth for years to come as below-market growth leases expire.”

Source: CBRE Investment Management, forecasts as of Q3 2023. For illustrative purposes only. Based on CBRE Investment Management’s subjective views and subject to change. There can be no assurance any targets or business initiatives will occur as expected. Forecasts are inherently uncertain and subject to change.

Built-in Diversification

Modern logistics facilities are not a monolith. Rather, e-commerce shops typically utilize a cluster of different fulfillment centers—each serving a specific role in the supply chain lifecycle:

- Intermodal facilities. Located near hubs like ports, airports, and railroad depots, these national distribution centers are farthest away from end consumers and function as a product’s first destination in its journey.

- Distribution facilities. Regionally located near interstates and thoroughfares accessible to major metropolitan areas, these outfits bring goods and merchandise one step closer to consumers.

- Fulfillment centers. Typically situated in commercial zones of urban districts mere miles from customer homes, these buildings are a product’s last pit stop before final delivery.

Each facility type bears a specific set of structural requirements with respect to square footage, roof loads—even parking structures—in order to streamline operations.

Accessing the Sector

Building a top-of-the-line logistics facility can cost anywhere from $20 million to upwards of $100 million, making access to this space a challenge for all but the biggest players. Fortunately, Westmount’s platform, relationships, and access to well-established institutional managers with long-term track records offers lower minimum investment opportunities for clients.

To learn more about how we access this space for our clients, call us at 310-556-2502 or visit westmount.com/alternatives.

Recent posts

Sources

1How COVID-19 Impacted E-commerce Trends in North America

2What is the Share of E-commerce in Overall Retail Sales?

3Euromonitor, CBRE Research, May 2021

4,5,6,7The Case for Modern Logistics Facilities

Disclosures

Copy by Andrew Bloomenthal

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent.

Past performance does not guarantee future results, and investing in stocks, alternatives, and bonds carries the possibility of loss of principal. Securities transactions carry risk and are not suitable for all investors. Before making an investment decision, you should consider whether this information is appropriate in your circumstances. Expected returns are provided by each respective manager based on their views of the current environment. There can be no certainty that performance or events will turn out as we or the managers have opined above.

If you have any comments or questions about this report, please contact us at info@westmount.com.