Net unrealized appreciation Can an NUA strategy help bolster retirement savings? By Tim Lonergan, CFP®, CPWA®, Senior Financial Planner

By Tim Lonergan, CFP®, CPWA®, Senior Financial Planner

Employer-sponsored retirement plans, such as traditional defined contribution plans like a 401(k) or Employee Stock Ownership Plans (ESOP), are popular and effective ways to save for retirement. Some plans also offer employees the ability to invest in their employers’ stock.

Typically, funds distributed from a pre-tax retirement account like a 401(k) are subject to ordinary income tax rates. However, if your pre-tax retirement income stream includes distributions from highly appreciated, low-basis company shares, you may have an opportunity to reduce your tax liability using an often-overlooked strategy known as Net Unrealized Appreciation (NUA). Below, we explore the benefits, limitations, and requirements of this specialized planning maneuver.

What is Net Unrealized Appreciation?

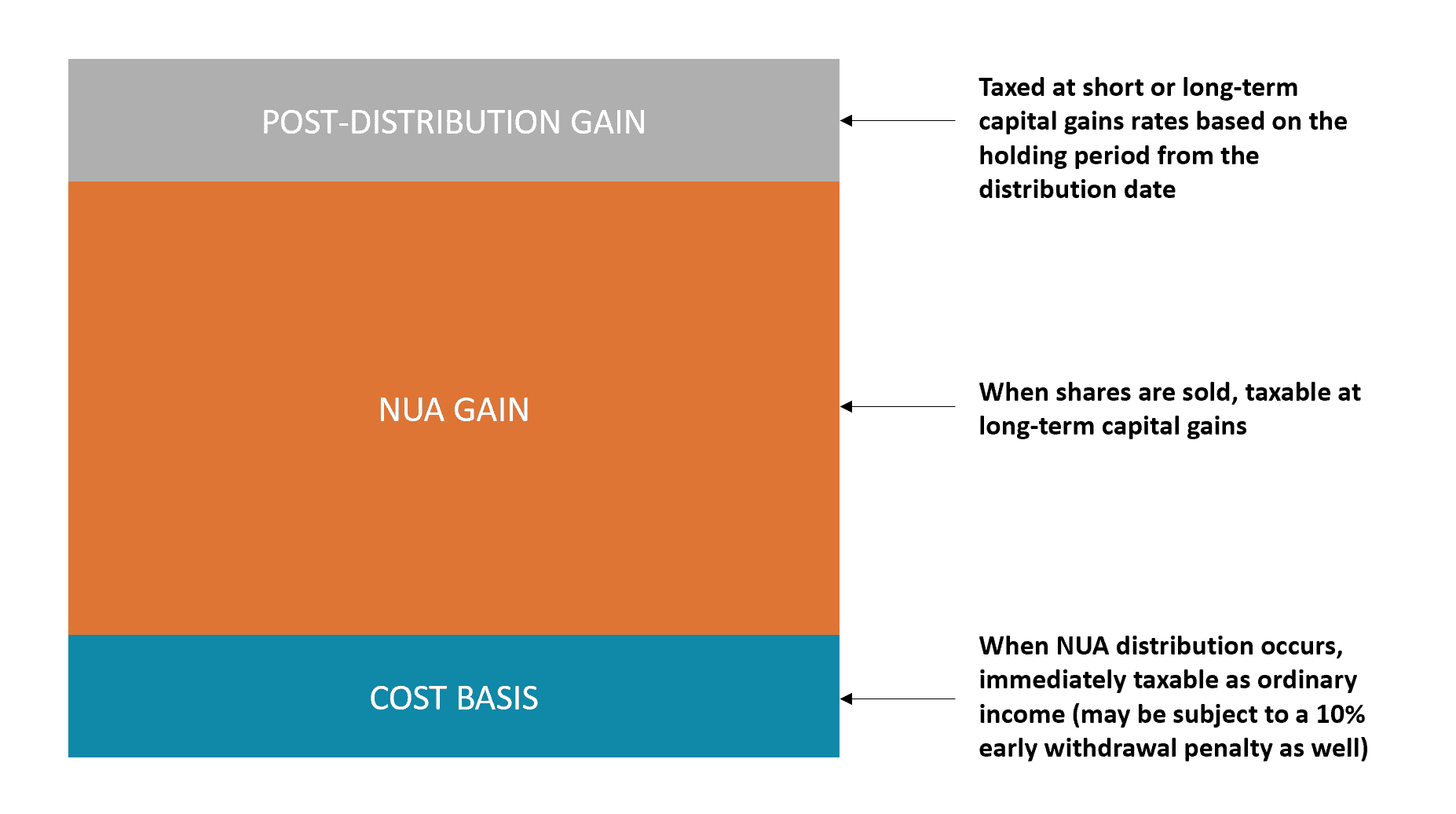

At its core, NUA is the difference between the cost basis of your shares (what you paid for them) and their current market value. An NUA strategy involves converting the tax characteristics of that appreciated value from ordinary income to long-term capital gains, which typically carry a lower tax burden.

Shares elected for NUA treatment are rolled into a separate brokerage account. While the cost basis of those shares is subject to ordinary income tax in the year they are transferred, the NUA itself would not be taxed until the shares are disposed of. When the shares are sold, they would be subject to long-term capital gains rates rather than ordinary income tax.1 Any additional growth above the NUA amount would be subject to short or long-term capital gains depending on the length of the holding period. Refer to the illustration below:2

Once transferred, shares receiving NUA treatment can be sold at any time, and the remaining account value (whatever assets were not selected for NUA treatment) can be rolled into an IRA without any tax implications. Importantly, NUA is not eligible for a step-up in basis upon death; however, any growth above the NUA portion would be eligible for a step-up.

Once transferred, shares receiving NUA treatment can be sold at any time, and the remaining account value (whatever assets were not selected for NUA treatment) can be rolled into an IRA without any tax implications. Importantly, NUA is not eligible for a step-up in basis upon death; however, any growth above the NUA portion would be eligible for a step-up.

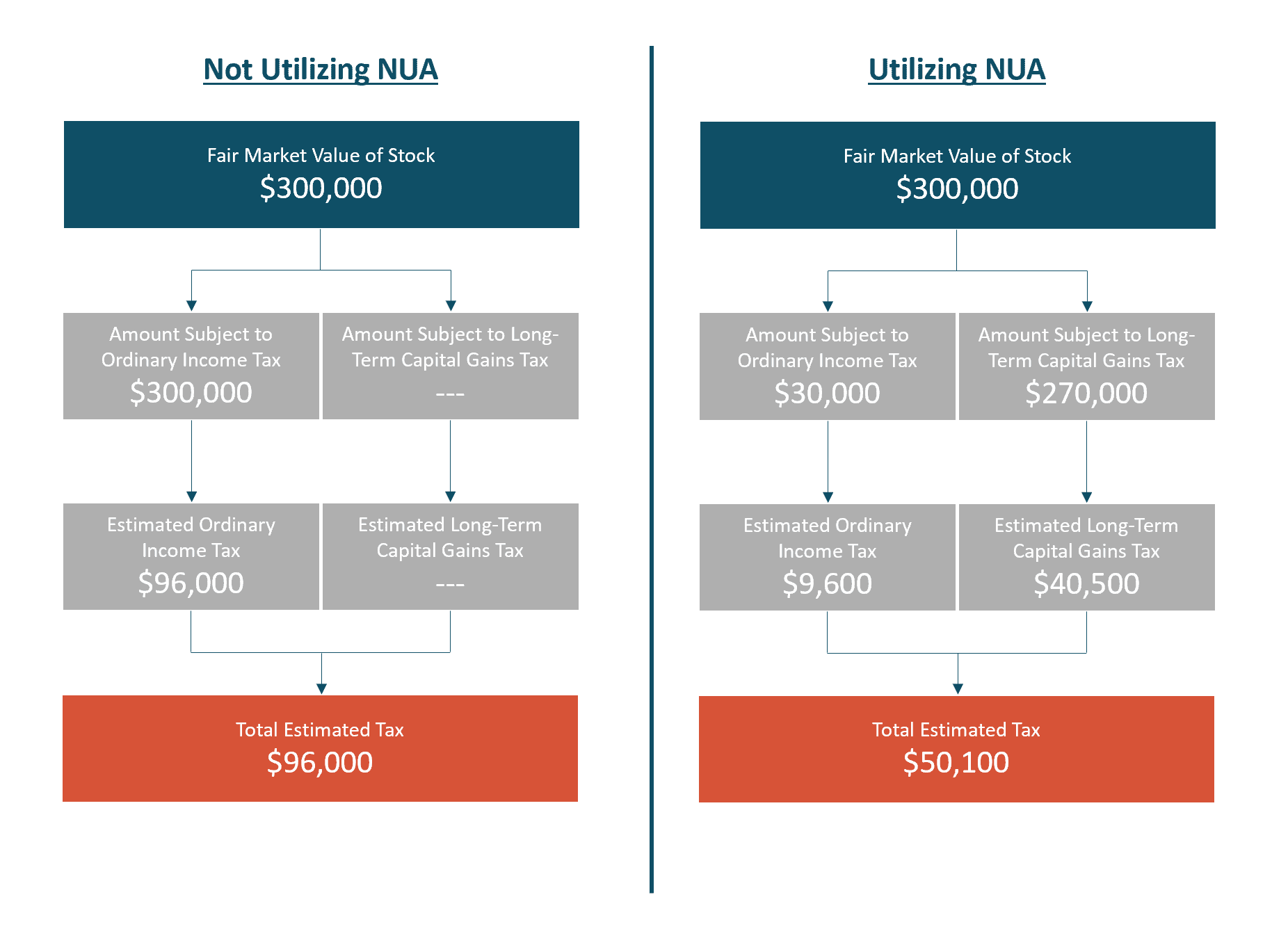

The example below illustrates a simplified scenario involving NUA.3 Let’s assume Tom is 60 years old and is retiring this year. Tom has most of his portfolio invested in his employer’s retirement plan. Part of his financial plan involves purchasing a sailboat when he retires. How should Tom access the $300,000 needed for his sailboat purchase, assuming a $30,000 cost basis and marginal tax rate of 32%?

What are the requirements to use NUA?

Certain requirements must be met before one can consider utilizing an NUA strategy. The IRS is extremely strict about compliance with these rules, making it vital to ensure they are followed correctly.

- The entire employer plan must be transferred in the same tax year, whether in a single lump sum or across multiple transactions. No matter how they’re distributed, you maintain flexibility as to where the funds ultimately end up.

- The portion of the company shares that will be utilized for NUA must be transferred in kind. You are not permitted to liquidate the shares before transferring them.

- The NUA maneuver must follow one of the qualified triggering events below:

- Reaching age 59.5

- Separation from the employer whose shares you hold (whether voluntarily or as a result of termination)

- Death of the account holder

- Disability of the account holder

Failure to satisfy these eligibility requirements will disqualify the transaction, potentially resulting in adverse tax consequences.

When is it appropriate to use an NUA strategy?

The NUA strategy is highly nuanced and may not be appropriate for everyone. However, there are some general situations where it makes sense to explore this strategy:

- Your employer stock has a very low cost basis. Generally, the lower the cost basis of your shares, the more you may benefit from an NUA strategy.

- Your tax rate is lower than you project it to be in the future. As we’ve mentioned, assets left in a pre-tax account will be subject to ordinary income tax when distributed. If you expect to pay a higher income tax rate in the future, converting a portion of the account to long-term capital gains treatment can create an arbitrage opportunity.

- You anticipate needing to utilize the assets in the near term. This is because compound interest would have less time to make its impact felt. Long-term investors should be more cautious about using NUA for this very reason. Additionally, NUA shares can be attractive targets for immediate gifting.

While the examples above can help us identify scenarios in which the NUA strategy may be suitable, we assess each client’s situation and circumstances individually. No two client scenarios are exactly alike. Westmount’s financial planning team can help you navigate through your individual circumstances with ease. Give us a call at 310-556-2502, email advice@westmount.com or contact your advisor directly to learn more.

Recent posts

Sources

1An additional early withdrawal penalty of 10% may apply if funds are distributed prior to reaching age 59½, unless an exception applies. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-exceptions-to-tax-on-early-distributions

2Source for chart

3The example shown assumes a scenario in which only federal income tax rates apply. It does not account for state income tax, net investment income tax (NIIT), or other potential ancillary tax implications.

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent. If you have any comments or questions about this article, please contact us at info@westmount.com.