Make real estate your friend Take advantage of rich returns, tax savings and built-in risk protection. Analysis by Dimitri Krikelas, Chief Investment Officer – Private Markets

Analysis by Dimitri Krikelas, Chief Investment Officer – Private Markets

The real estate market is one of the largest asset classes with a global market cap estimated to be over $38.1 trillion.1 Property ownership can provide a rewarding path to wealth by offering participants access to income streams as well as appreciation and tax benefits through ownership in a hard asset.

Real estate is a broad category that encompasses a wide swath of assets, including single- and multi-family residential property types, commercial buildings, hospitality, industrial spaces—even raw land. Other real estate categories can include less traditional spaces like cell phone towers, data centers, self-storage, among others.

Investing in real estate offers the potential to generate alpha into an investor’s portfolio. In the residential space, shorter-term tenancies give property owners a chance to affect regular incremental rent adjustments that can help mitigate inflation pressures. And building-wide improvements—say, upgrading fitness centers or installing new appliance packages—help owners ultimately sell entire properties for premium dollars, creating portfolio-enriching liquidity events. On the commercial front, long-term leases lock in attractive income streams over the long haul, giving real estate investors yet another path to cash flow visibility and profitability.

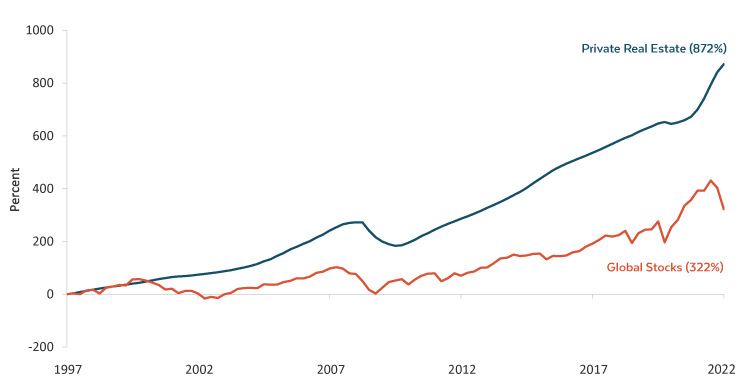

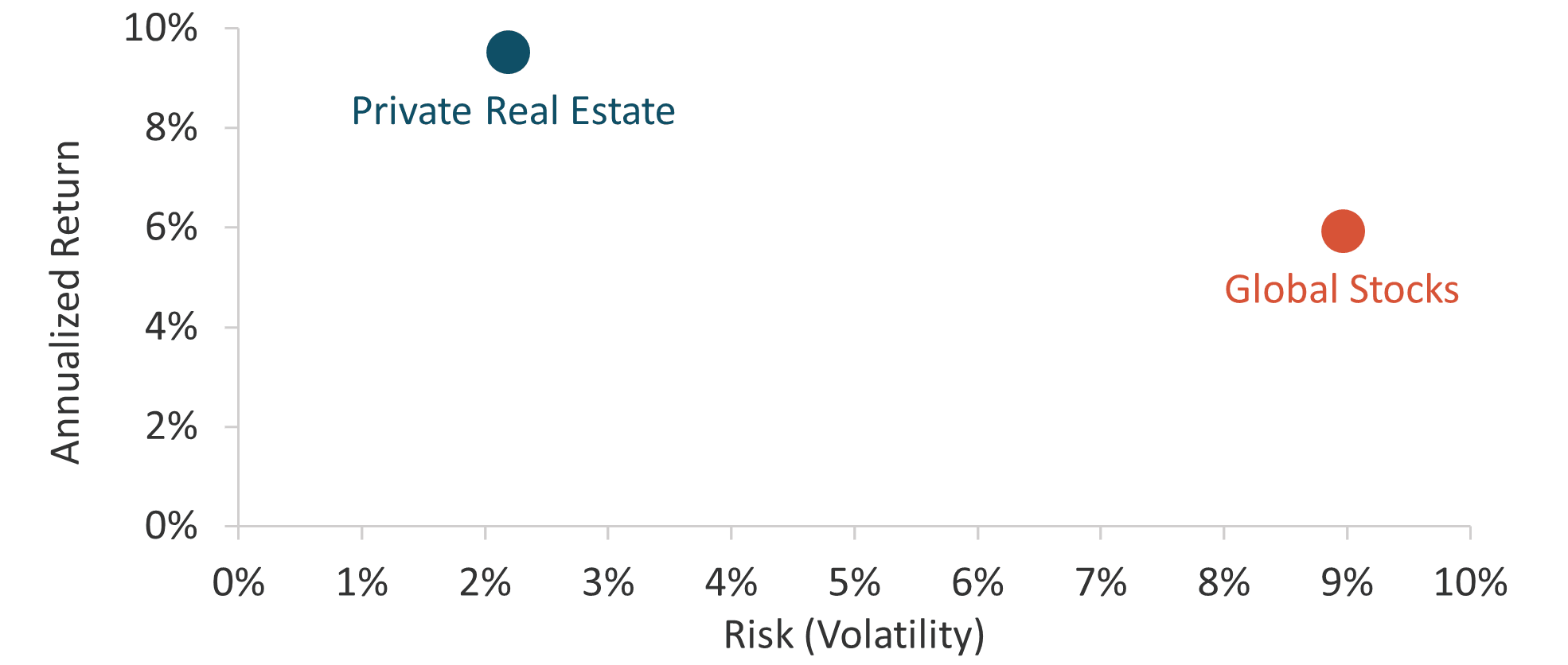

Overall, real estate equity returns have proven to be historically less volatile than many other asset classes. Case in point: over the past 25 years leading up to mid-2022, private real estate ushered in annualized returns close to 10% with significantly less volatility than global stocks, whose annualized returns hovered at around 6%.2 Cumulatively, real estate returns for that same quarter century grew a whopping 872%—trouncing the 322% growth for global stocks.3

Source: Bloomberg as of June 30, 2022. “Private Real Estate” represented by the NCREIF Property Index. “Global stocks” represented by the MSCI World Index.

This is an asset class that produces stable cash flow and consistent returns with built-in inflation hedges. The typical one-year leases utilized in residential real estate can be renegotiated every time a tenant rolls out, so if interest rates rise and operational expenses increase, managers can meet costs by increasing the rental rates written into new leases in order to maintain margins.

Source: Bloomberg as of June 30, 2022. “Private Real Estate” represented by the NCREIF Property Index. “Global stocks” represented by the MSCI World Index.

Triple-Net Leases

Short-term leases in the residential market aren’t the only risk-mitigating properties under the real estate equity banner. Commercial properties can employ a structure in their contracts with long-term tenants known as a triple-net lease (“NNN Lease”) as a solution for reducing uncertainty. Under this model, the business owners (lessees) are responsible for maintenance costs and capital expenditures—including real estate taxes and property insurance—throughout the duration of the lease, which can span 10 or more years. This structure creates more stable cash flows for lessors, who can breathe easy knowing they’re not on the hook for less predictable infrastructural improvements or other maintenance costs.

In other words, clarity and predictability of cash flow stabilizes the income component of an investment to reduce overall volatility.

Variable Strategies

Real estate investors can deploy a number of market strategies to maximize their return potential or provide additional diversification. Chief among them:

- Core: Broadly viewed as the safest strategy, the term “core” refers to properties that are fully leased, with conservative debt. Due to their low-risk profiles, core real estate holdings are likened to fixed income investments. Reliably achieving 7%-10% annualized returns, decades-long leases make this asset class one of the most hands-off long-term real estate strategies around.4

- Core-Plus: Viewed as a low-to-moderate risk profile, this approach is characterized by owners who have the ability to increase cash flow through light property improvements. Similar to core properties, these assets tend to be of high-quality and well-occupied. Investors in Core-Plus properties can expect to see 9%-13% annualized returns.5

- Value-Add: In this moderate-risk strategy, assets tend to have low occupancies and require considerable capital expenses for renovations. In addition to physical overhaul, owners may need to grapple with operational inefficiencies. However, once properties are stabilized, managers can sell them at opportune times for handsome gains, earning investors annualized returns in the 11%-15% range.6

- Opportunistic: Considered the most aggressive category, this high-risk/high-potential return strategy involves properties in need of major enhancements—often saddled with significant debt and high vacancy rates. Included in this subset are developments still under construction, plus all the permitting headaches, construction delays, and other logistical hurdles that come with them. Although these challenges can delay tenant occupancies for years to come, patient opportunistic investors aim for a higher return profile in the neighborhood of 20%.7

As real estate investors, we believe it’s important to not only diversify your real estate portfolio by property type, but also by strategy. For example, while Value-Add and Opportunistic strategies can offer the highest return potential over time, they are most susceptible to challenges during economic slowdowns or when interest rates rise given higher debt loads. And those are the times Core and Core-Plus strategies tend to perform better. Understanding market cycles, debt structures, supply/demand dynamics, and how different property types behave are vital factors that go into our analysis as an overlay to constructing a diversified real estate portfolio.

Distinct Tax Advantages

There are terrific tax benefits when it comes to real estate investing. For example, when opportunistic scenarios arise for managers to sell buildings at a profit, investors can defer their federal 15%-20% capital gains consequences to generate further wealth via a “1031 exchange.” Also known as a “like-kind” exchange, this third-party trust account lets investors swap one property for another single property or group of properties, provided the new assets are utilized for the same business purpose as the original ones and that the new properties aren’t used as an investor’s primary residence.

In another scenario where the strategy involves holding the asset over the long-term, depreciation is recognized as one of the greatest tax shelters. Depreciation is the process used to deduct the costs of buying and improving a rental property. The ability to offset some—if not all—of the annual rental income is a critical component to building wealth over an extended period of time.

Putting Experience to Work

The variable strategies in the real estate equity space are vast. Whether it’s residential or commercial; whether it’s for rental income collection or development for sale; whether it’s Core, Core-Plus, Value-Add, or Opportunistic, Westmount has curated relationships with managers and operators whose experience helps investors achieve stable returns over time.

Learn more

To learn more about how we access this space for our clients, call us at 310-556-2502 or visit westmount.com/alternatives.

Recent posts

Sources

1 CBRE Investment Management, Oxford Economics, as of February 2023

2,3 Private Real Estate” represented by the NCREIF Property Index. “Global stocks” represented by the MSCI World Index. Past performance is no guarantee of future results. Actual results may vary.

4,5 Difference in Core, Core Plus, Value-Add, and Opportunistic Real Estate (bullpen.com)

6 Core Plus Real Estate: A Guide to Core+ Properties by FNRP (fnrpusa.com)

7 Distressed and Opportunistic CRE Funds: Explained (wealthmanagement.com)

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent.

Past performance does not guarantee future results, and investing in stocks, alternatives, and bonds carries the possibility of loss of principal. Securities transactions carry risk and are not suitable for all investors. Before making an investment decision, you should consider whether this information is appropriate in your circumstances. Expected returns are provided by each respective manager based on their views of the current environment. There can be no certainty that performance or events will turn out as we or the managers have opined above.

If you have any comments or questions about this report, please contact us at info@westmount.com.

Copy by Andrew Bloomenthal