Alternatives continue to shine A look at where stocks, bonds, and alts are headed. Market Review by Terrence Demorest, Chief Investment Officer - Public Markets and ESG

Market Review by Terrence Demorest, Chief Investment Officer - Public Markets and ESG

5 October 2022

The third quarter started on a high note. Optimism about easing inflation and minimal damage to the economy briefly returned to the markets after the sharp selloff in the first half of the year. Stocks and bonds both experienced solid rallies.

Things turned dark again, though, when the Federal Reserve sharpened its rhetoric mid-quarter, communicating to investors that it would ratchet up rates decisively until inflation was well under control. Intra-quarter, the markets seesawed more than 10%, but once the dust settled stocks had fallen another -6.8% in the quarter.

Westmount’s stock allocations are designed to track the global stock market in a highly tax-efficient and very low-cost manner. We seek the high average returns that stocks have long delivered as the reward for enduring significant volatility and varied annual returns along the way. Consistent with this objective, our clients’ stock portfolios largely outperformed the global markets by a bit over 1.0% and finished down -5.8% for the quarter (similarly, for the year through Sept. 30, stocks here and abroad are down -25.6%, and Westmount stock portfolios are down -24.6%).

An Unprecedented Year for Bonds

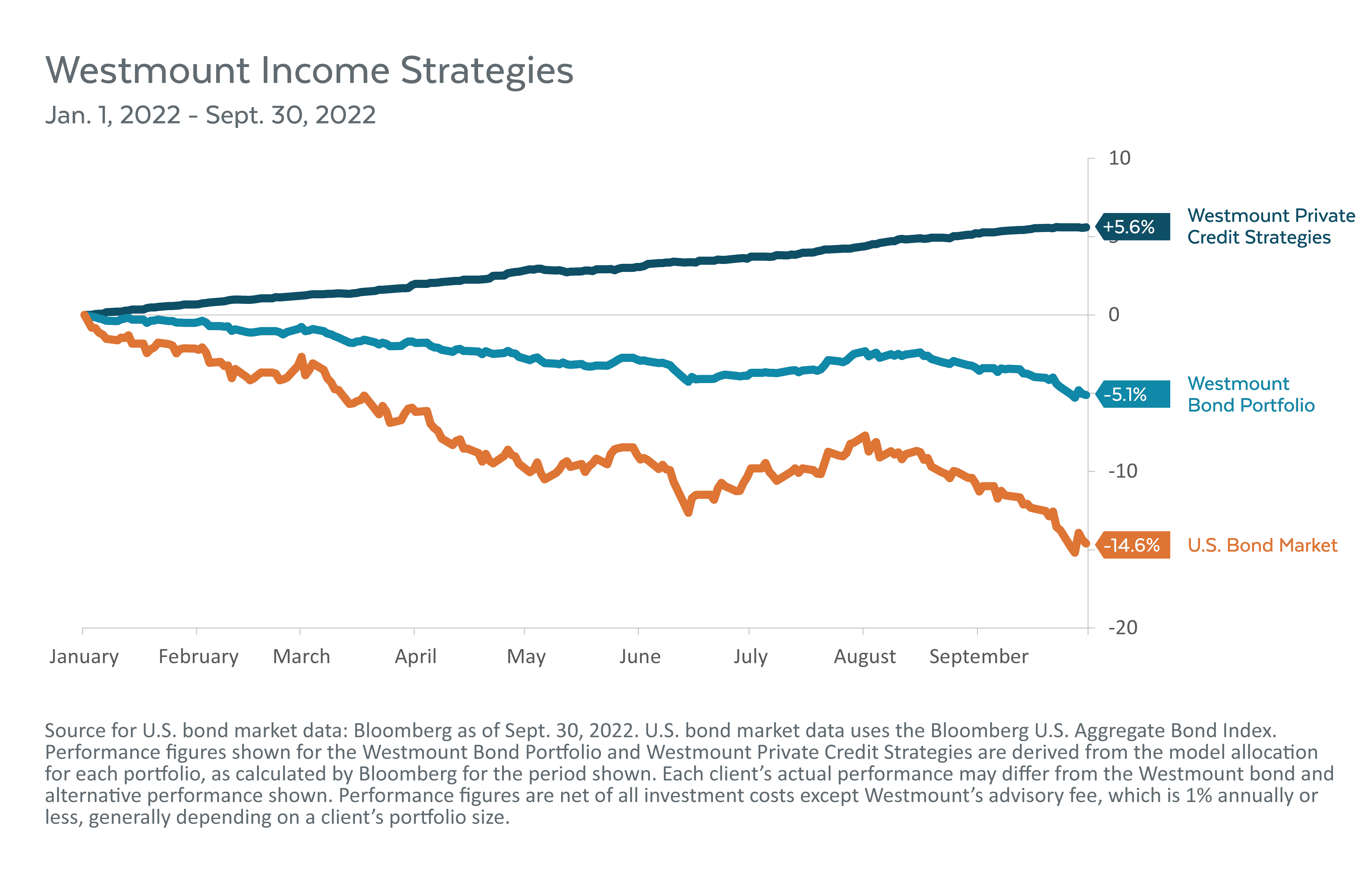

While stocks continued to receive most of the headlines, within the investment community bonds were the much bigger story. Stocks have experienced severe selloffs many times in the past, but this year’s poor performance for bonds is unprecedented. As the Fed initiated additional jumbo-sized interest rate hikes to cool the economy, bonds sold off sharply, continuing the trend from the first half of the year, and finished the quarter down another -4.8%.

Heading into the fourth quarter, Westmount’s bond portfolio maintained its positioning of very low sensitivity to rising interest rates while taking very selective credit risk. The positioning was well-rewarded, as our bonds were down only -1.3% (for the first three quarters of the year, the bond market is down an astonishing -14.6%, while our clients’ bond portfolios are down around -5.1%).

Alternatives Continue to Shine

The brightest spot in client portfolios continues to be alternative assets. We have specifically targeted a segment of this broad asset category that focuses on real estate and corporate loans that are collateralized by real estate and other tangible assets. Unlike many traditional fixed income securities, private loans tend to be floating rate in nature, meaning payments to the investor rise as interest rates go up. The high income from these loans has continued to provide investors a healthy cash flow stream, and their floating rate feature has largely protected them from price declines as rates have shot up. Despite the high volatility of the quarter, our alternative assets provided a smooth ride, finishing the quarter up roughly +1.9% (and they’re up approximately +5.6% for the year through Sept. 30).

It is impossible to know where the markets are headed in the near-term, largely because it’s way too soon to know what the ultimate impact of the Fed’s interest rate hikes (and other global events) will be on the economy. That said, markets and economies are cyclical in nature, and every previous decline has been followed by a meaningful recovery; we anticipate a similar outcome for this cycle as well. We believe the financial markets have largely priced in the scenario of a modest recession, though we could experience a more severe economic downturn. Once there is greater clarity about the economy, and the expectation of a recovery from any weakness, the markets will respond accordingly and resume their long-term climb. In the meantime, we will maintain our tactical positioning in all three main portions of our clients’ portfolios and seek to capitalize on particularly attractive opportunities that may arise.

Recent posts

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent.

The performance figures for the representative Westmount Moderate Balanced portfolio are derived from the composite performance of the stock, alternatives, and bond portions of all fully-invested client accounts. Client allocations are customized and may have different asset mixes and performance. The actual performance and allocation of individual client accounts will vary. Performance figures include the reinvestment of dividends and are net of all investment costs except Westmount’s advisory fee, which is 1% annually or less, generally depending on a client’s portfolio size. Westmount’s fees are described in Part 2 of our Form ADV, which is available upon request.

Stock and bond market performance data from Bloomberg as of Sept. 30, 2022. Past performance is no guarantee of future results, and investing in stocks, alternatives, and bonds carries the possibility of loss of principal. Securities transactions carry risk and are not suitable for all investors. Before making an investment decision, you should consider whether this information is appropriate in your circumstances.

The various market indices and representative portfolios on the chart are provided to assist clients in evaluating Westmount’s performance relative to the markets in which we invest. Westmount’s portfolios are not intended to perfectly mirror the relevant indices, may have more or less volatility than the indices, and may invest in markets and strategies not represented by any of the indices shown. The indices are unmanaged and do not carry fees or expenses.

If you have any comments or questions about this article, please contact us at info@westmount.com.