A word about cash Optimizing cash reserves for higher returns Market Review by Scott Fellmeth, CIPM®, Senior Advisor

Market Review by Scott Fellmeth, CIPM®, Senior Advisor

While the Federal Reserve Bank’s rapid escalation of interest rates in 2022 wreaked havoc on the stock and bond markets, one advantage was that it led to higher yields for investors on cash and cash-like instruments (including money market funds and CDs). After earning near zero on cash for several years, savers finally saw respectable yields in the 5% range on “risk-free” cash.

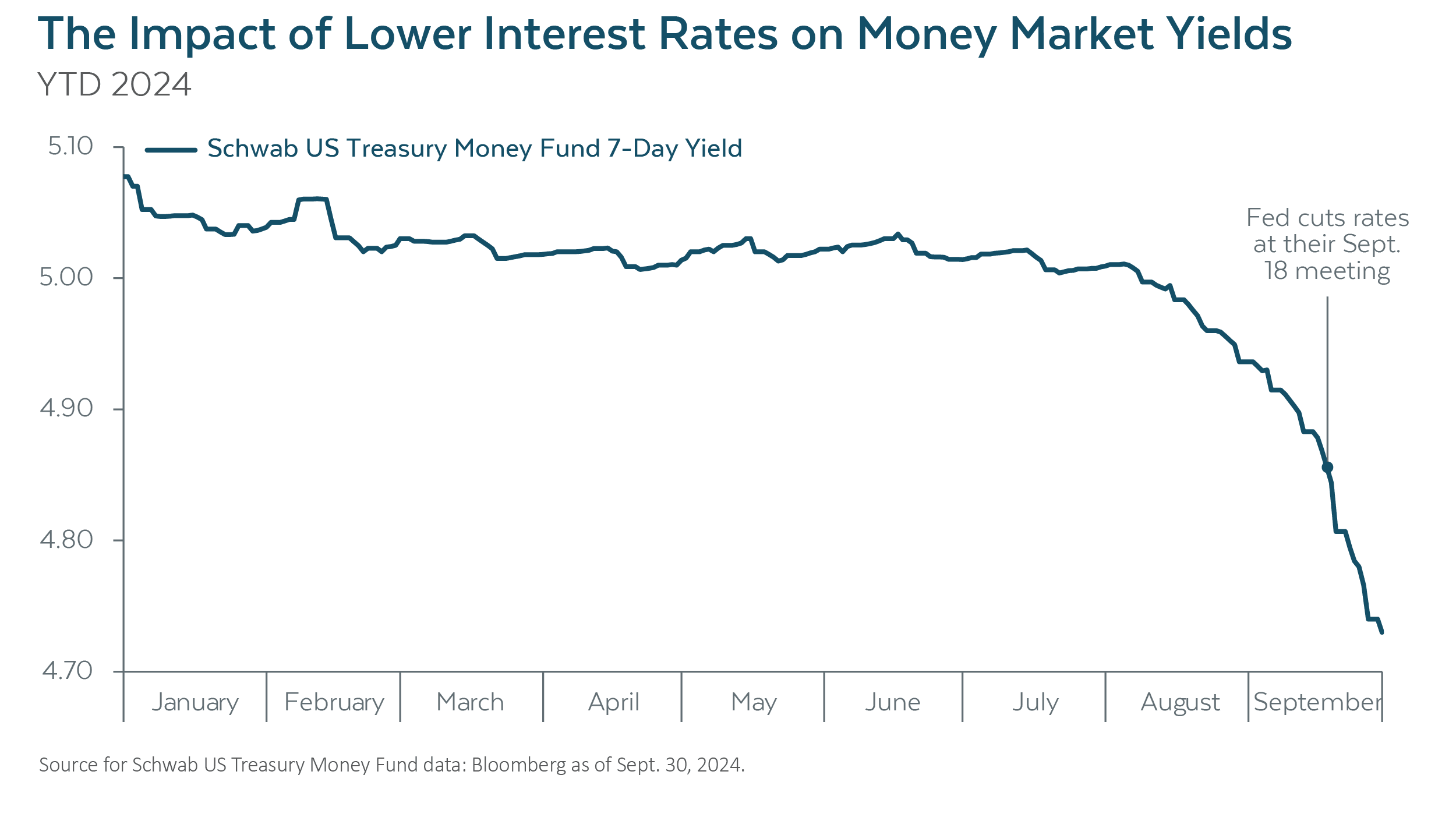

Unfortunately, as the chart below reveals, these yields drop rapidly when the Fed starts to lower rates, meaning the current yields investors are receiving on their cash are unlikely to continue.

To maintain higher yields, investors instead should reinvest cash into bonds that have longer maturities than cash instruments. When rates fall, the value of fixed-rate bonds, all else equal, increases, compensating investors for the lost yield. Other income-producing investments—like our allocation to private credit—also present an attractive alternative to cash for most investors.

With the Fed now signaling its intention to continue lowering rates, clients should get ahead of the cuts by investing their longer-term cash reserves into higher-returning investments. If you are currently holding a significant amount of cash that is not earmarked for a current use, we recommend that you speak with your Westmount advisor about ways to better deploy the funds before the next round of cuts brings rates down even further.

Recent posts

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent. If you have any comments or questions about this article, please contact us at info@westmount.com.