Navigating the nuances of private credit Opportunities and risks in a booming market Analysis by Dimitri Krikelas, Partner and Chief Investment Officer - Private Markets

Analysis by Dimitri Krikelas, Partner and Chief Investment Officer - Private Markets

As businesses seek timely and flexible financing solutions, many are turning to private lenders—who can often structure and execute loans with greater speed, adaptability, and efficiency than traditional banks—to meet their capital needs. At the same time, yield-oriented investors are increasingly drawn to the private credit market, attracted by its compelling income potential. However, investors must use caution when evaluating investments, as not all private credit funds are created equal.

There’s no getting around it: Companies are increasingly turning to private credit over traditional banks for loans—a shift that has driven a significant expansion in private lending activity in recent years. From about $1 trillion in 2020, private credit assets under management spiked to $1.5 trillion in 2024, with forecasts projecting a surge to $2.6 trillion by 2029.1

With a vast opportunity set, this has undoubtedly created attractive opportunities for investors looking to increase their allocations to private credit. However, they may risk taking an oversimplified view of the private credit universe by painting with too broad a brushstroke. In reality, the expansive spectrum of products is deeply nuanced and complex.

“Simply put: not all private credit is created equal,” explains Dimitri Krikelas, Westmount’s Chief Investment Officer for Private Markets. “Each offering carries unique risk profiles and return prospects that must be carefully observed, so knowing the different types of credit and fund structures in the space is critical.”

Why Private Credit is Thriving

Private credit’s ascent can’t be attributed to one single factor. Still, there are a few noteworthy trends worth commenting on—not the least of which being rising interest rates, which can amplify potential returns. This is mainly because most private lending activity uses floating-rate loans based on a reference rate like the Secured Overnight Financing Rate (SOFR) plus a spread. When these reference rates increase, so does the yield on the investment.

However, the floating rate model isn’t a universal standard. Some private loans instead rely on fixed-rate coupons, which is a key differentiator in the private credit investment space, and can decidedly inform strategy. To wit: investors who foresee an interest rate spike would be wise to position their portfolios in floating rate products. Conversely, if future rates are expected to drop—as they are in the current market, experienced portfolio managers may seek to overweight the fixed rate approach.

Another key differentiator is deal size—a highly negotiable figure that caters to borrowers’ objectives. This is particularly important for middle-market firms, which often require the kind of tailored financing solutions that traditional bank loans may not be willing or able to provide. Generally speaking, larger deals are more competitive. After all: fewer firms have enough capital to make loans in the billions than those who can lend in the millions. Consequently, smaller off-market deals empower lenders to negotiate more favorable terms.

Other factors, like a fund’s fee structure, use of leverage, repayment schedule, geographical bias(es), industry exposure, and liquidity features must also be factored into the mix. It takes an experienced advisor to see through all of these nuances to build a quality client portfolio. However, those willing and able to undertake the significant work of parsing through all these different variables can achieve the diversified asset allocation mix needed to match their risk/return profiles. Nonetheless, it can be a significant lift without the necessary infrastructure in place.

Not Monolithic

By definition, private credit straddles a wide swath of subcategories. These include:

- Collateralized loan obligations (CLOs): These structured securities bundle pools of lower-rated corporate loans, then sell them to investors in tranches, offering higher-than-average returns by assuming the default risk. Typically incorporating a leverage component, CLOs are similar to collateralized mortgage obligations in structure, but differ because they’re backed by company loans rather than mortgages.

- Real estate: Non-bank lenders furnish loans for various commercial real estate projects, including rental units, construction projects, and fix-and-flip properties. Real estate private credit tends to offer more flexible terms and quicker approval windows than conventional bank loans.

- Direct lending: These privately negotiated senior secured loans made by non-bank lenders to privately owned companies are either structured as bilateral agreements between a single lender and borrower–or as “club deals” involving small groups of lenders. Direct lending primarily benefits small- to mid-sized businesses that may not enjoy the same access to traditional bank financing as larger enterprises.

- Asset-backed lending: Also known as “asset-based” lending, this subsector is characterized by lenders being repaid with contractual cash flows generated by a defined pool of hard or financial assets such as mortgages, leased aircraft, car loans, and royalties from intellectual property like music rights.

- Equipment lending: A subset of asset-backed lending, this niche offering refers to the provision of loans to equipment manufacturers seeking capital for equipment purchases or upgrades to fuel growth. This is achieved by leveraging the value of the equipment itself to secure the loan.

- Sponsored lending: These arrangements typically involve private equity firms that provide capital to startups, where financing is directly negotiated between lenders and borrowers, thus eliminating the need for intermediary banks to arrange the terms. Sponsored lending is less risky than non-sponsored lending because it includes third-party due diligence and managerial support. In fact, private equity fund managers often take seats on company boards to lend institutional oversight in order to help emerging companies tilt towards profitability.

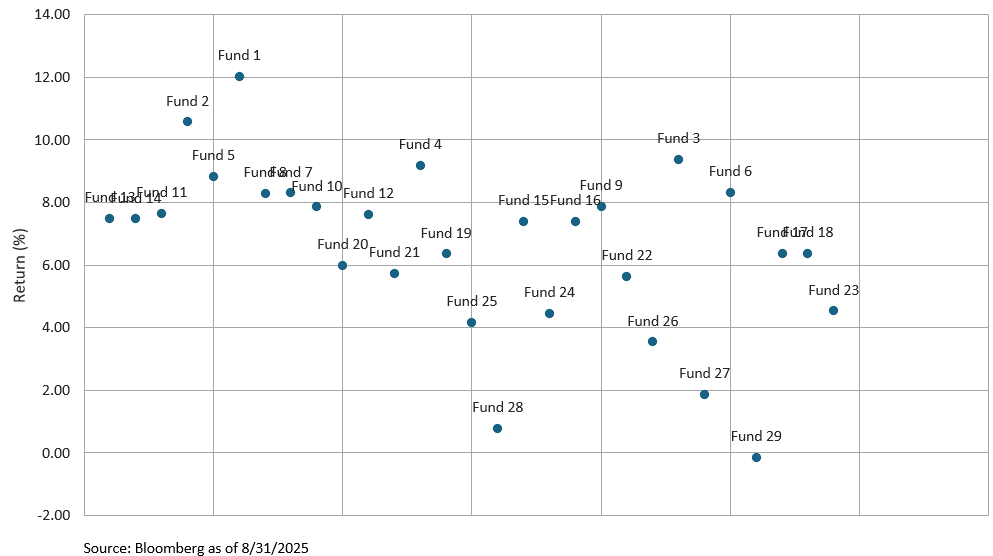

As the chart above shows, the wide range of returns underlines how vetting private credit investment opportunities goes beyond ascertaining a laundry list of metrics. It also requires an experienced eye to ferret out opportunities and an ability to negotiate fees and other key deal points.

As the chart above shows, the wide range of returns underlines how vetting private credit investment opportunities goes beyond ascertaining a laundry list of metrics. It also requires an experienced eye to ferret out opportunities and an ability to negotiate fees and other key deal points.

“Knowing what’s out there is just the starting point,” notes Krikelas. “Westmount’s experience and analysis enable us to carve out high quality portfolios in the private credit space that elevate the prospect of investment success across different economic cycles.”

Take the next step

Private market assets typically carry high investment minimums and require investors to have the right relationships, sourcing channels, and due diligence capabilities. To learn more about how we navigate these challenges for our clients, call 310-556-2502 or visit westmount.com/alternatives.

Recent posts

Disclosures

Copy by Andrew Bloomenthal.

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent.

Past performance is not indicative of future results. Investment returns will fluctuate, and investors may experience a loss. No guarantee or representation is made that any investment strategy will be successful or achieve any particular results. All investments involve risk, including the possible loss of principal. Different types of investments involve varying degrees of risk, and there is no assurance that any specific investment will be profitable.

If you have any comments or questions about this article, please contact us at info@westmount.com.