Markets rocked by powerful financial and geopolitical forces Several factors propelled stocks forward in 2021. Now they're facing headwinds. Learn why. Analysis by Terrence Demorest, Chief Investment Officer - Public Markets and ESG

Analysis by Terrence Demorest, Chief Investment Officer - Public Markets and ESG

While stocks were fueled in 2021 by a reopening global economy and record-high corporate profitability, markets have struggled this year in the face of very stiff headwinds. Inflation is currently at levels not seen in 40 years, the Federal Reserve has begun its determined plan to hike interest rates, and the Russian invasion of Ukraine has created havoc in Europe and threatens to have wider implications.

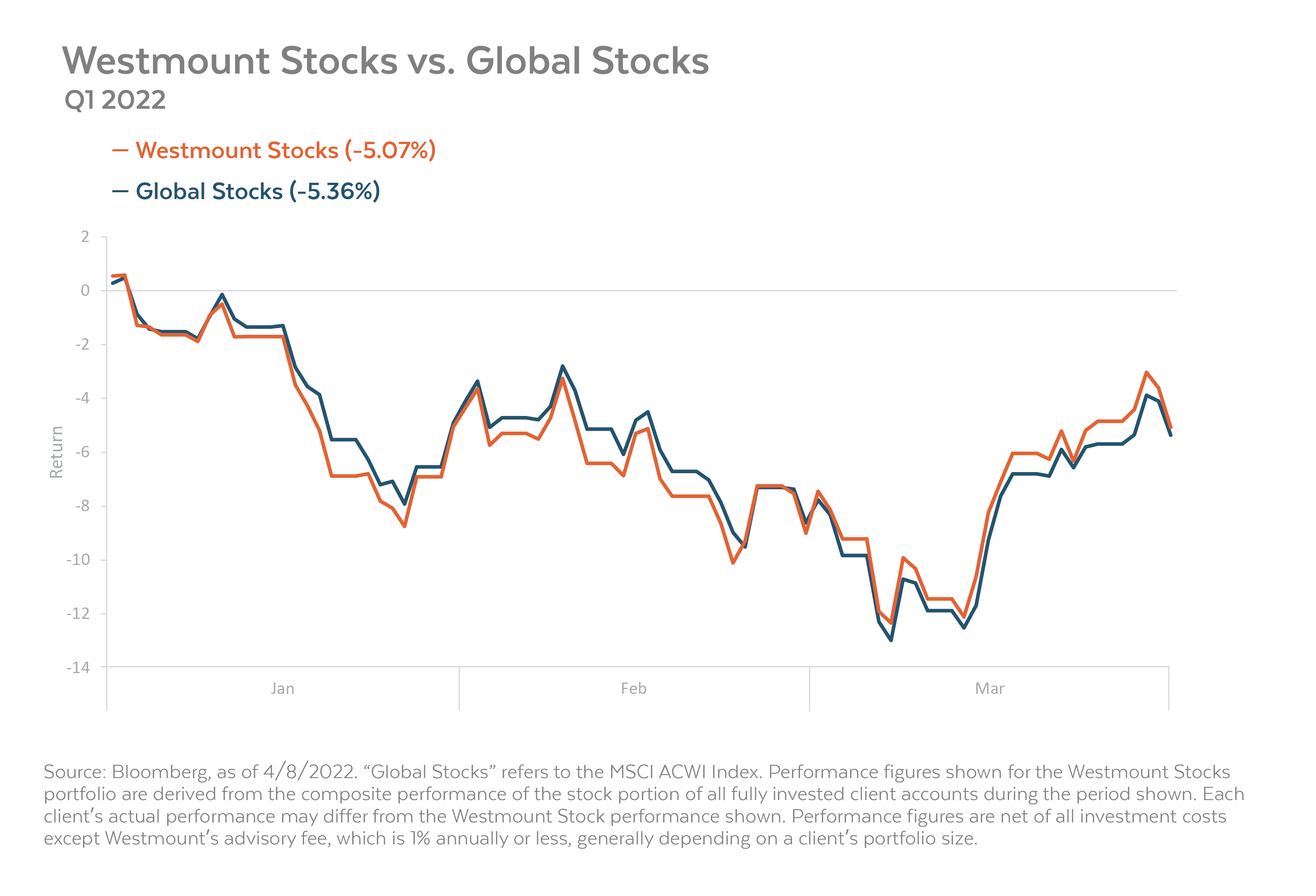

In reaction to these shocks, the global stock market fell -13.40% during the quarter before rebounding somewhat, ending the quarter at -5.36%. Westmount’s diversified stock portfolio is designed to track the global stock market fairly closely (and in an extremely low-cost and highly tax-efficient manner), and our clients’ stock portfolios slightly outperformed global stocks, falling -5.07%.

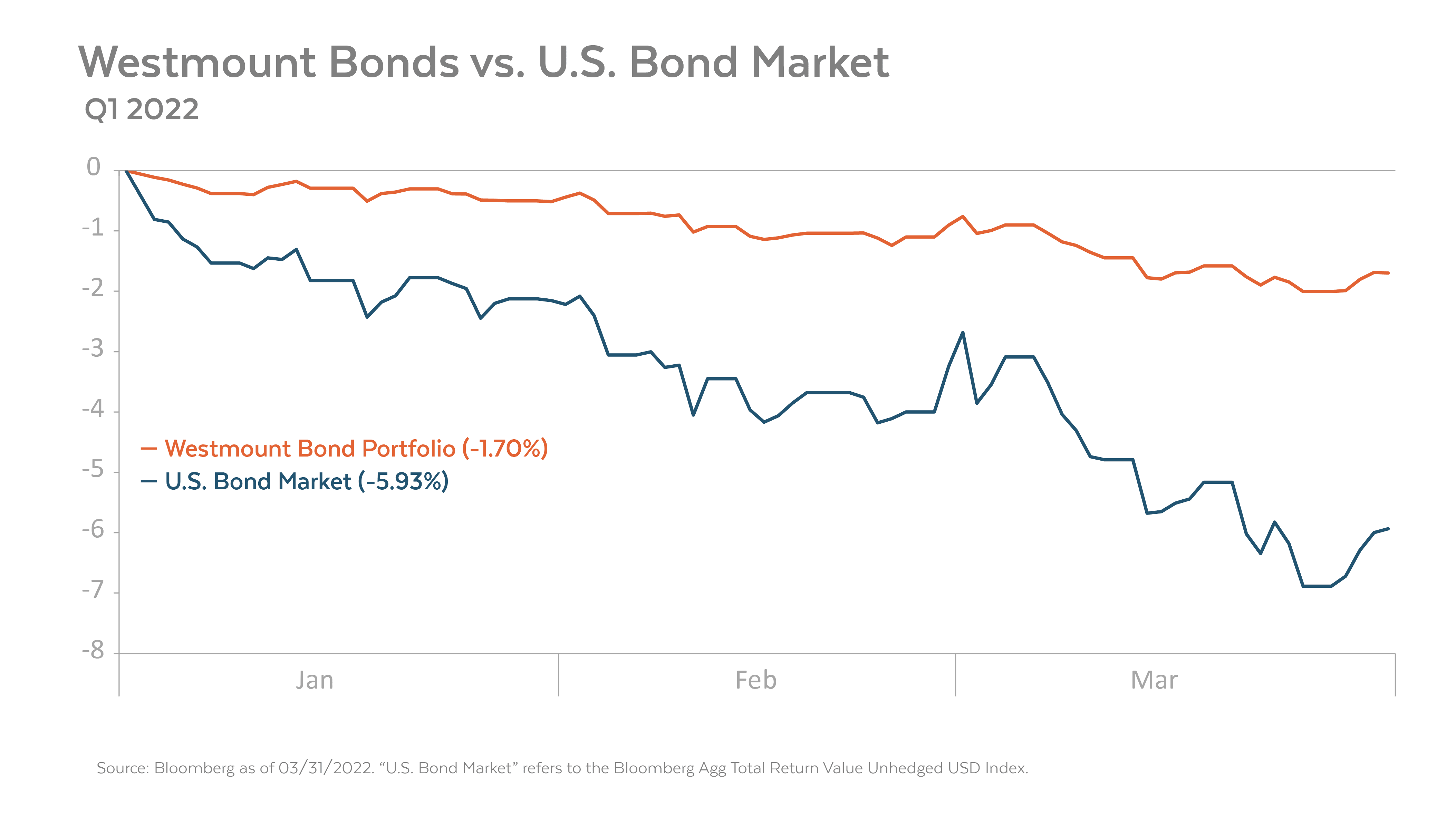

Times of uncertainty and heightened risk normally attract capital to the bond market, but the Federal Reserve’s determination to combat inflation by applying the brakes caused the bond market to spiral downward in its worst quarterly performance since 1980, ending the quarter with a -5.93% return. Having proactively positioned our clients’ bond portfolios to have materially less interest rate sensitivity than the broader bond market (while selectively taking more credit risk), we were able to significantly outperform the bond market, returning -1.70%.

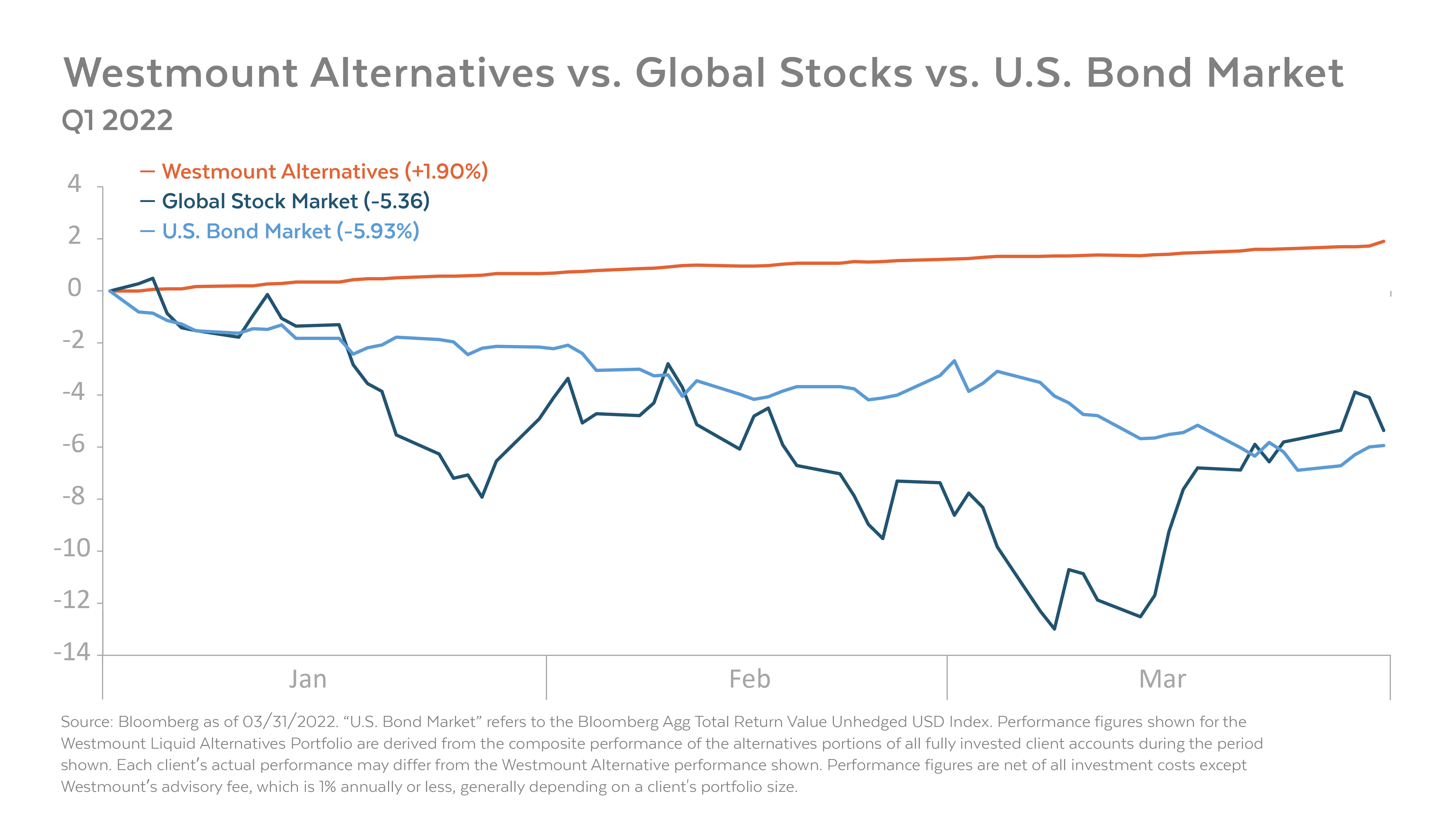

Alternatives Continue to Shine

In a welcome contrast to the falling stock and bond markets, the alternative assets in our clients’ portfolios delivered positive returns and provided much needed diversification. As we mentioned in the last edition of Quarter Notes, our current alternative asset portfolio consists primarily of investments in private credit. As a refresher, private credit refers to real estate and corporate loans that are collateralized by real estate and other tangible assets. Often floating rate in nature, interest payments can adjust up (or down), providing further benefits to conservative investors in a period of rising interest rates. Private credit continues to provide high income in what is still an historically low-yielding environment.

Recent posts

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent.

The performance figures for the representative Westmount Moderate Balanced portfolio are derived from the composite performance of the stock, alternatives, and bond portions of all fully-invested client accounts. Client allocations are customized and may have different asset mixes and performance. The actual performance and allocation of individual client accounts will vary. Performance figures include the reinvestment of dividends and are net of all investment costs except Westmount’s advisory fee, which is 1% annually or less, generally depending on a client’s portfolio size. Westmount’s fees are described in Part 2 of our Form ADV, which is available upon request.

Stock and bond market performance data from Bloomberg as of March 31, 2022. Past performance is no guarantee of future results, and investing in stocks, alternatives, and bonds carries the possibility of loss of principal. Securities transactions carry risk and are not suitable for all investors. Before making an investment decision, you should consider whether this information is appropriate in your circumstances.

The various market indices and representative portfolios on the chart are provided to assist clients in evaluating Westmount’s performance relative to the markets in which we invest. Westmount’s portfolios are not intended to perfectly mirror the relevant indices, may have more or less volatility than the indices, and may invest in markets and strategies not represented by any of the indices shown. The indices are unmanaged and do not carry fees or expenses.

If you have any comments or questions about this article, please contact us at info@westmount.com.