Real estate transitions and family wealth For those wondering what's next for their real estate investments. Update by Westmount's Planning Team

Update by Westmount's Planning Team

28 February 2023

For all its challenges—illiquidity, market valuations, intensive management, among others—real estate investing can provide a rewarding path to significant wealth, with consistent cash flow and asset appreciation.

At Westmount, we’re privileged to advise a number of families who have significant real estate holdings. Often, real estate comprises the majority of their wealth. In meeting with these clients to refine their financial plans, we often come to an important crossroads: What’s next for their real estate investments?

As you might imagine, the answers to that question are as varied as the families who engage our help. We strive to pin down quantifiable metrics, such as capitalization rate, cash flow, depreciation, and tax treatment. Equally important are family issues, such as a real-estate owner’s interest in keeping the asset, concern for a surviving spouse, or the readiness—or interest—of the next generation in assuming control of the assets.

Given the prevalence of this issue, we’ve created the hypothetical case study below. The clients described in this scenario represent a composite of clients we have advised on this topic, with identifying details removed.

The Solution

Meet the Smiths: Robert is 70 and Sheila is 68. They have about $50 million of commercial property that they own together, as well as $15 million in liquid assets.

Robert has invested in real estate his whole life and is used to managing his own wealth, with guidance from his accountant and attorney. He owns, operates, and manages the properties, taking a very active role.

He is very comfortable with real estate investing but realizes that his wife and two adult children (aged 42 and 40, respectively) have been shielded from much of the day-to-day business dealings. His children are working professionals and are busy raising children of their own. A tight-knit family, the Smiths get along well and are proud of their family culture.

Robert and Sheila are both in good health, but they realize that real estate investing can be burdensome and require sustained attention. They are somewhat uneasy about the prospect of an illness or injury that would sideline him from actively managing their properties. They also recognize that real estate is time intensive, preventing them from taking a long trip or moving to another state, if desired.

The Goal

The Smiths are looking for advice about the most efficient way to transfer their real estate wealth to their two adult children. These are the main factors they are weighing as they make this decision:

- Determining the optimal time to conduct their real estate transaction.

- Minimizing the tax liability for themselves and their two children.

- Reducing stress, especially if one spouse becomes incapacitated.

- Preserving good relationships with their children, particularly as it relates to the family business.

- Facilitating peaceful and positive interactions between the siblings.

- Leaving an enduring legacy for their children, grandchildren, and—ideally—the generations that follow.

The Process

The Smiths have managed their own money in the past, but the scale of their real estate wealth has led them to wonder if they have all the information they need to assess their options. In the spirit of “we don’t know what we don’t know,” they agreed to meet with our planning team and Mike, a senior advisor at Westmount, who had been referred by a friend.

In their first meeting, our team learns all they can about Robert and Sheila’s situation – their financial profile, of course, but also their intentions for their real estate holdings, their retirement aspirations, their family dynamics, and their tax situation. Mike explains that he is responsible for coordinating steady progress on shared initiatives across the members of his clients’ tax and legal teams. As a result, clients see him as the go-to resource for any financial need that touches their lives.

Equally important, Mike adds, is our team’s ability to uncover potential solutions that align with each client’s situation and review these options to find an ideal outcome. We undertake this goal in concert with specialists at the firm, each of whom brings in-depth expertise in a particular area: investments, tax, financial planning, and wealth transfer planning. Mike also explains that he serves as a sounding board and guide to multiple generations of client families, from patriarchs and matriarchs through Millennials and Generation Z.

The Options

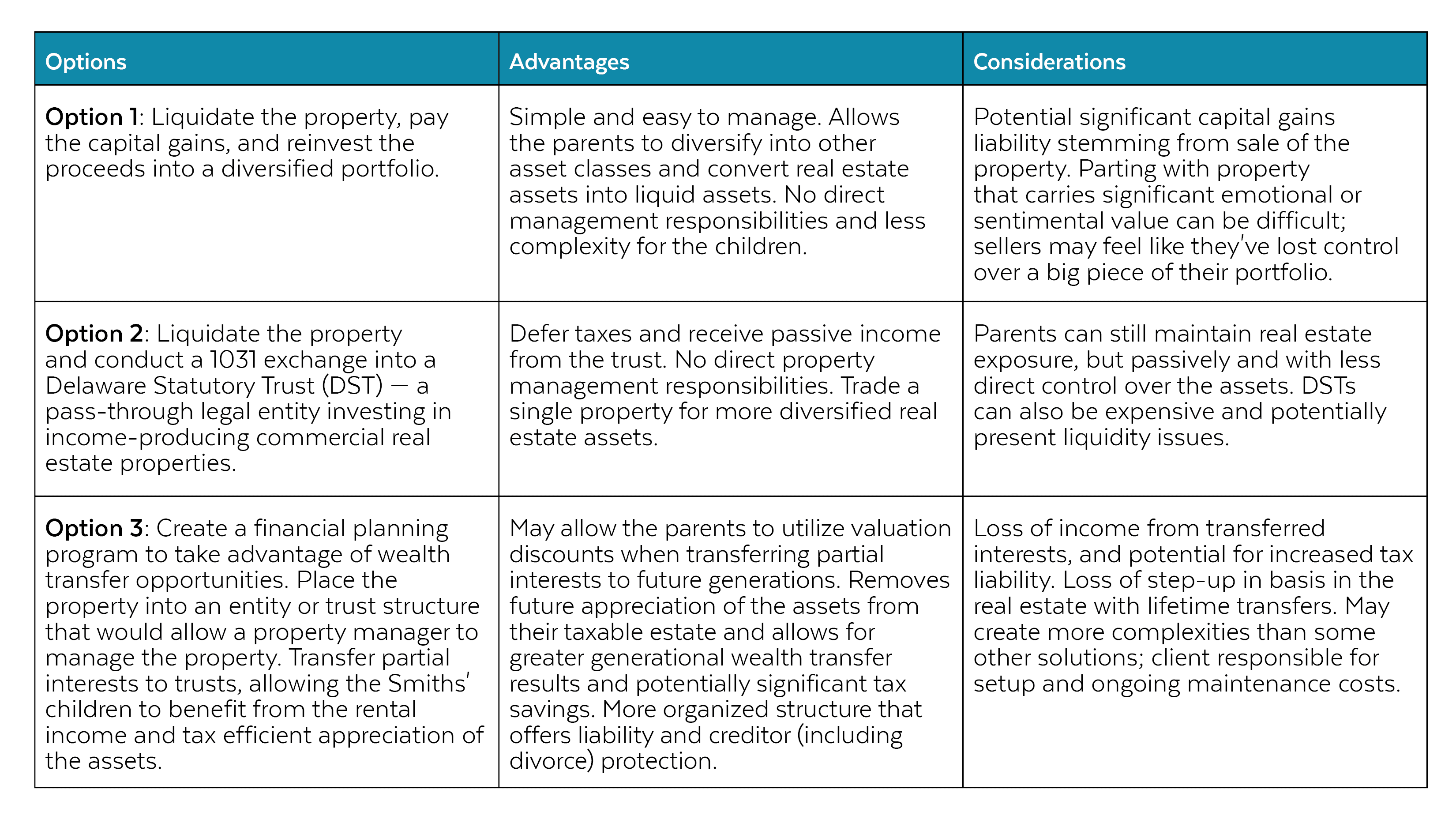

After speaking with the Smiths, quantifying their holdings, prioritizing their goals, and collaborating with Westmount’s wealth planning specialists, Mike and our team outlined three options to consider:

Through further discussions, they together explored the potential benefits and drawbacks of each of the three possibilities. During these conversations, they evaluated near- and long-term factors like financial projections, possible tax consequences, wealth planning considerations, and alternative investment options. As they neared the end of the process, the Smiths remarked that they found our integrated approach helpful and felt that they had a partner in Westmount who could help them through the transition process in collaboration with their other legal and tax advisors.

Through further discussions, they together explored the potential benefits and drawbacks of each of the three possibilities. During these conversations, they evaluated near- and long-term factors like financial projections, possible tax consequences, wealth planning considerations, and alternative investment options. As they neared the end of the process, the Smiths remarked that they found our integrated approach helpful and felt that they had a partner in Westmount who could help them through the transition process in collaboration with their other legal and tax advisors.

As a next step, Mike offered to convene a meeting with the family’s accountant and attorney so that, together, they can vet their options more thoroughly. Naturally, the Smiths had more questions, but felt confident in our team’s analysis and recommendations.

The Path Ahead

Robert and Sheila are a fictional couple, of course, but their situations are drawn from real life. If you see reflections of your own circumstances in this story, please reach out to us at 310-556-2502 or by emailing info@westmount.com. We would be happy to learn more about your situation and discuss your options, helping you consider what’s next for your real estate assets and the long-term well-being of your family.

Recent posts

Disclosures

This article was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission. The information contained in this article was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this article may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent.

If you have any comments or questions about this article, please contact us at info@westmount.com.