Tariff policies roil markets in a volatile Q2 But, diversification and discipline were rewarded by Terrence Demorest, Chief Investment Officer for Public Markets & ESG

by Terrence Demorest, Chief Investment Officer for Public Markets & ESG

Stocks and bonds rose in the second quarter, but investors first had to endure significant losses before markets ultimately turned around, finishing with modest gains at the midyear mark. The market swings were driven almost exclusively by investor reactions to the Trump administration’s tariff policies and closely tracked the changes in those policies made during the quarter. Alternative investments, most notably private equity and private credit (debt), similarly gained ground during the quarter, but did so without experiencing the high levels of volatility seen in the public markets.

Stocks

The quarter began with a jolt as President Trump’s “Liberation Day” tariff announcements triggered a sharp market sell-off. The S&P 500 dropped more than 12% over just four trading days, culminating in the fourth-worst start to a calendar year since 1928. Sentiment quickly shifted, however, as the administration reversed course by either pausing or significantly scaling back the proposed tariffs. This policy pivot sparked one of the strongest short-term rallies on record, with the S&P 500 rising +22% over the final 12 weeks of the quarter. The rebound was reinforced by a -64% drop in the VIX—a widely watched gauge of stock market volatility—representing the largest 12-week decline in its history.

By quarter-end, the S&P 500 had returned to all-time highs, supported further by reduced tensions in the Middle East and renewed investor focus on corporate earnings and a healthy economic backdrop. The chart below captures the volatility in the U.S. stock market in the first half of the year, particularly during the second quarter.

International stocks also fared well in the second quarter. In fact, a weakening U.S. dollar magnified returns on overseas investments, resulting in non-U.S. markets outpacing their domestic counterparts by one of their widest margins in decades.

Westmount’s stock portfolios closely tracked overall market performance, finishing the quarter up +10.94% and up +7.62% for the year as of June 30. This matched the S&P 500’s +10.94% Q2 gain (up +6.20% as of June 30), but trailed the MSCI All Country World Index, which rose +11.53% in Q2 (up +10.05% as of June 30). This year-to-date underperformance is due to our strategic overweight to large-cap U.S. stocks, which has produced considerable outperformance over the past five years.

Alternatives – Growth

The newest addition to our investment lineup—the alternatives-growth portfolio—is designed to enhance long-term portfolio growth by investing in privately-held companies. This asset class, commonly known as private equity, offers access to businesses earlier in their development cycle, often before they reach the public markets. By identifying strong companies in their growth phases, private equity aims to generate outsized returns that may not be available through traditional public equities.

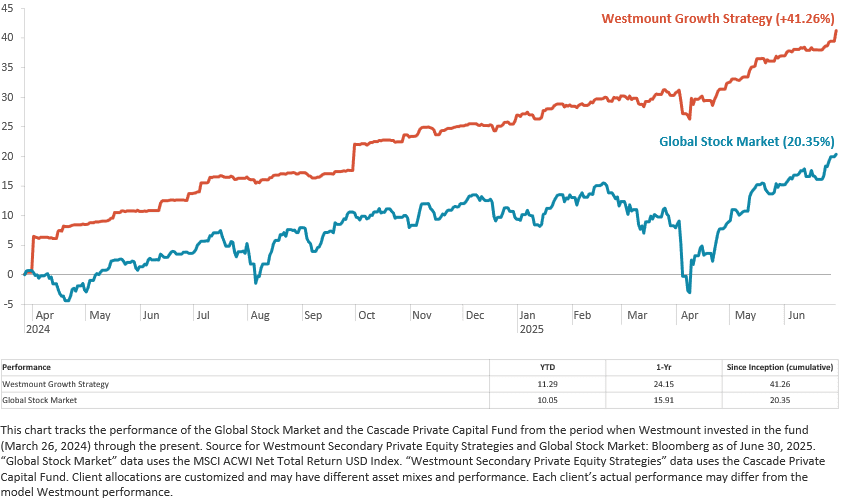

Despite the broader market volatility at the start of Q2, the alternatives-growth portfolio remained more stable and ultimately delivered impressive performance, ending the quarter up +8.06%. At midyear this section is up +11.29%. This strong result reflects the value of strategic exposure to private markets as a complement to traditional equity holdings. The outperformance of our clients’ private equity holdings versus the public markets during our holding period can be seen in the chart below:

Alternatives – Income

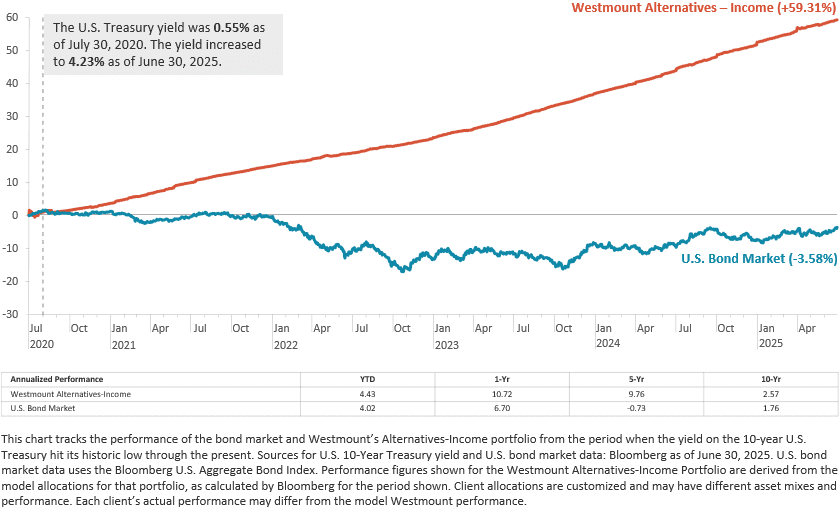

While market volatility picked up meaningfully at the start of Q2, our alternatives-income portfolio remained stable and continued to deliver strong, consistent returns. For nearly five years, this portfolio has been anchored in private credit—an asset class that has proven to be both resilient and rewarding across market cycles. The high returns and low volatility of this allocation are clearly reflected in the chart below:

Private credit typically involves senior secured, floating-rate loans made to small and mid-sized businesses, as well as to real estate sponsors. These loans often offer higher yields than those available in the public bond markets, reflecting their bespoke structure and relatively illiquid nature.

In Q2, the portfolio remained steady and reliable, posting a return of +1.89% (and is up +4.43% year-to-date, as of June 30). That outpaced the Wilshire Liquid Alternative Total Return Index, which returned +1.81% (and +2.59% as of June 30), and continued the trend of consistent outperformance that has defined this allocation for some time.

Bonds

Much like the equity markets, the bond market experienced its share of volatility in early Q2—albeit to a lesser degree. Concerns over the expanding federal deficit and persistent inflation served as key catalysts, pushing yields on long-dated bonds higher as investors demanded greater compensation for taking on increased risk. Meanwhile, tensions between Fed Chair Powell and President Trump remained visible, particularly around the direction of short-term interest rates. The Federal Reserve held rates steady throughout the quarter, opting to wait for clearer signals on the path of economic growth and inflation.

As the tariff-related uncertainty eased, intermediate and long-term yields began to settle, reflecting a decline in perceived risk. This stabilization helped bond investors recover ground and regain confidence.

Westmount’s bond portfolio performed well against this backdrop, generating strong returns with notably lower volatility. Our strategy—focused on selectively owning short-term credit while maintaining exposure to high-quality, intermediate-duration investment-grade bonds—continued to prove effective.

Westmount’s bond portfolio returned +1.27% in the quarter (and is up +3.34% as of June 30), compared with the Bloomberg U.S. Aggregate Bond Index, which rose +1.21% in the quarter (and is up +4.02% as of June 30).

Recent posts

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent.

Past performance is not indicative of future results. Investment returns will fluctuate, and investors may experience a loss. No guarantee or representation is made that any investment strategy will be successful or achieve any particular results. All investments involve risk, including the possible loss of principal. Different types of investments involve varying degrees of risk, and there is no assurance that any specific investment will be profitable.

Performance figures shown are net of all investment costs, including Westmount’s advisory fee. As of June 30, 2025, the average blended advisory fee across Westmount’s client base was 0.59%. The blended fee rate varies over time, and in some periods has been higher or lower than the fee rate reflected in this report. Performance also includes the reinvestment of dividends. Westmount’s fees are described in Part 2 of our Form ADV, which is available upon request. If you have any comments or questions about this article, please contact us at info@westmount.com.