The power of shareholder engagement Shareholder activism is on the rise. How are companies responding? Market Review by Terrence Demorest, Chief Investment Officer – Public Markets and ESG

Market Review by Terrence Demorest, Chief Investment Officer – Public Markets and ESG

Within the realm of environmental, social, and governance (ESG) investing, shareholder activism is on the rise as investors pressure companies to act on issues pertaining to climate change, social justice, and corporate transparency.

Beyond merely screening for companies that do (or do not) adhere to agreed-upon ESG standards, shareholder engagement initiatives usually involve investors directly participating in dialogues with the companies they invest in, influencing corporate decision-making, and holding management accountable for adherence to ESG principles.

There are a number of ways shareholders can pressure companies to take action, including:

- Dialogues and meetings: The most direct form of engagement involves investors exercising their rights as shareholders to encourage policy changes or raise awareness about specific ESG issues.

- Proxy voting: Shareholders may also exercise their rights by voting on proposals related to ESG matters during annual meetings.

- ESG reporting and transparency: Shareholders may request that companies enhance their ESG disclosures, enabling more informed decision-making.

- Sponsoring academic research on specific issues in order to raise awareness among the public.

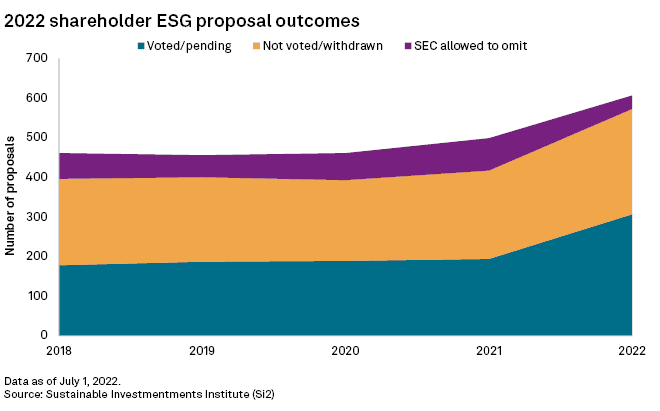

Shareholders presented 607 resolutions pertaining to ESG issues in 2022, up 22% from the year before.1 More resolutions were also withdrawn in 2022 compared to previous years—an indicator, advocates say, of increased negotiations between shareholders and company management, which suggests that shareholders are also becoming more successful in their efforts.2

What’s Driving the Rise of Shareholder Engagement Initiatives?

The growth of shareholder engagement can be attributed to several factors. First, investors—regardless of what’s in their portfolios—have a vested interest in mitigating risk and capitalizing on timely market opportunities. In addition to traditional metrics, ESG investors align their investment decisions with sustainability principles in hopes of further enhancing a portfolio’s resilience and performance over time.

Investors are also increasingly sensitive to societal pressures that call for more responsible corporate behavior. As influential stakeholders, shareholders recognize the growing power they hold to press for better ethical conduct, reduced carbon footprints, diversity and inclusion, and improved supply chain transparency.

Regulatory bodies and institutional investors, too, are starting to endorse ESG integration by encouraging companies to adopt more responsible practices. As a result, shareholder engagement becomes a strategic tool for investors to foster positive changes that align with evolving regulatory and industry standards.

Despite More Proposals, Companies Can Be Slow to Act

Proponents of shareholder initiatives argue that companies that engage with their shareholders and respond positively to their concerns tend to demonstrate better environmental practices, stronger labor policies, and enhanced corporate governance standards. Consequently, these companies appear more attractive to ESG-focused investors, leading to potential valuation premiums and improved long-term financial performance.

And yet, even as 2022 was a record year for shareholder proposals, corporate boards have been slow to respond. One survey found that companies acted on—and implemented—fewer than two out of five proposals submitted last year.4

Still, corporate boards are feeling the pressure, both from investors but also from consumers. A recent PwC survey found more than 60% of consumers now base their purchase decisions on sustainability and ethical criteria, a number that is growing by 10% each year.5 Companies that claim progress on sustainability targets should also expect more scrutiny from not only consumers and investors, but also regulators and internal staff who are becoming more discerning when it comes to ESG disclosures.

Recent posts

Sources

1,2,3https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/record-number-of-shareholder-esg-proposals-in-2022-defies-gop-political-backlash-71181308

4https://www.unpri.org/active-ownership-20/are-corporate-boards-responding-to-successful-shareholder-esg-proposals/11160.article

5https://www.pwc.com/kz/en/publications/new_publication_assets/esg-trends-in-2023-eng.pdf

Disclosures

This document was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission. Westmount believes the sources used in this document are reliable, but Westmount does not guarantee their accuracy. The information contained herein reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update the contents of this document. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this document may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount‘s prior written consent. If you have any comments or questions about this report, please contact us at info@westmount.com.