A strong fourth quarter caps another rewarding year for well-diversified investors by Terrence Demorest, Chief Investment Officer for Public Markets & ESG

by Terrence Demorest, Chief Investment Officer for Public Markets & ESG

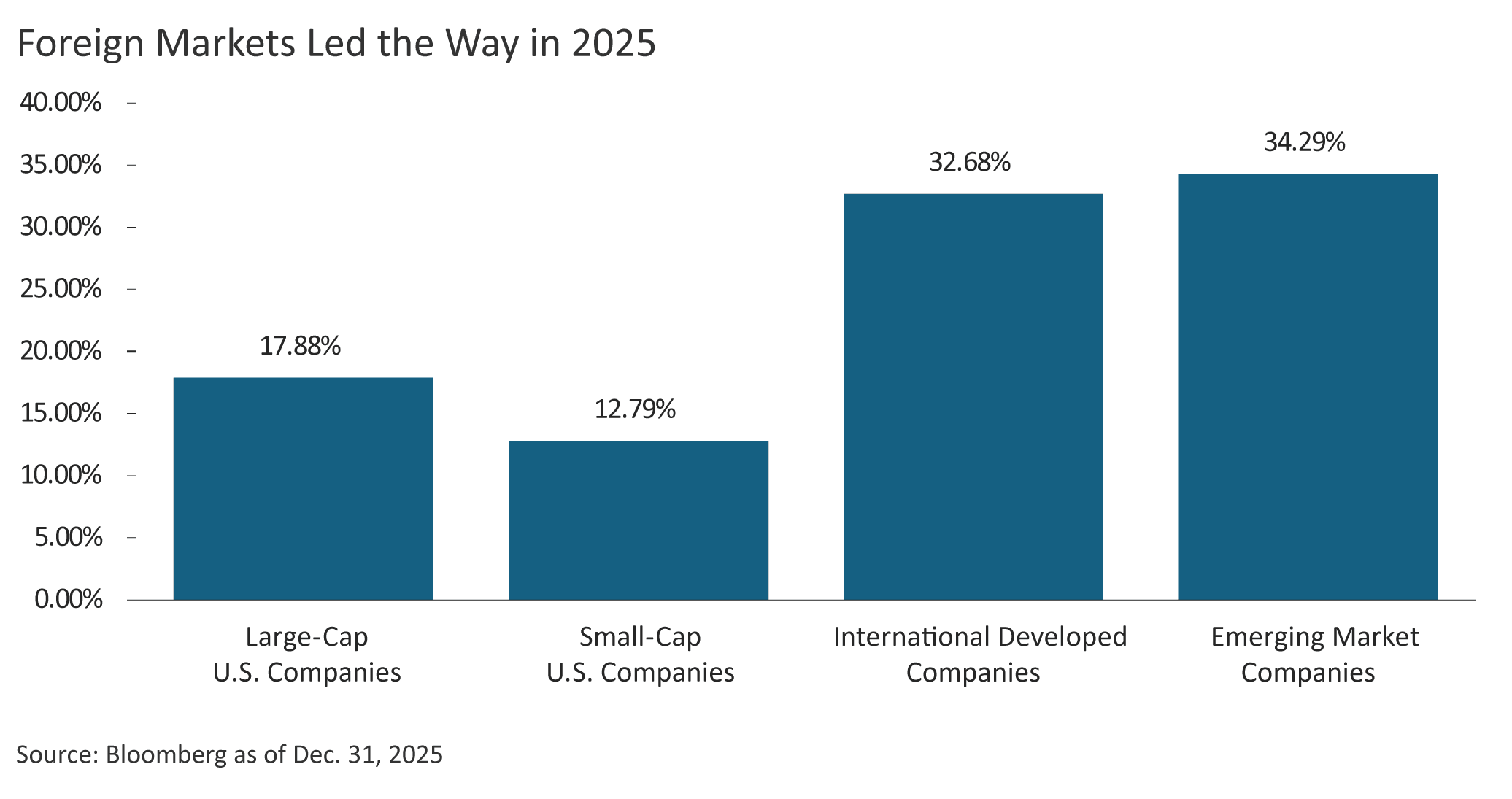

The financial markets continued their upward climb in the fourth quarter, finishing 2025 with substantial gains across a broad range of asset classes. Reflecting the overall health of the U.S. economy, stocks once again led the way, with large U.S. companies gaining 2.7% during the quarter and finishing the year up 17.9% (as reflected in the S&P 500 Index). We saw even greater strength in stocks outside the U.S.: the global stock benchmark (the All Country World Index, which measures a mix of U.S. and foreign stocks), gained 3.3% in the fourth quarter and 22.3% for the full year. Notably, 2025 marked the third consecutive year of double-digit returns for the major equity indexes, following the market’s dismal downturn in 2022.

Bonds also contributed meaningfully to portfolio returns. The U.S. bond market gained 7.3% for the year, including its 1.1% gain in the fourth quarter. Alternative investments continued to play an important role as well, providing steady income and diversification. Private credit (lending to private companies and on real estate) maintained its now-lengthy record of consistent performance, while private equity (ownership interest in private companies) continued to support long-term growth objectives.

Looking ahead to 2026, the investment backdrop appears more mixed. The underlying economy remains sound, but is showing signs of strain with unemployment rates edging higher. Inflation is still above the Federal Reserve’s target level, and the Fed has signaled a slower pace of further rate cuts. After three years of strong performance, stock valuations have become more elevated, making additional near-term gains harder to achieve. The stock market’s ascent—partially driven by the promise of productivity gains from artificial intelligence—could be challenged by disappointments or delays in fulfilling the promise of AI. In this environment, a balanced approach across asset classes—and a long-term perspective—remain essential to managing risk while continuing to pursue attractive returns.

Stocks

International equities were the clear standouts in 2025. Developed international markets rose 32.7% for the year, while emerging markets gained 34.3%, both comfortably outpacing the S&P 500’s 17.9% return. This performance represented a meaningful shift after nearly a decade of U.S. market dominance.

Several factors drove this rotation. As U.S. equity valuations became increasingly stretched, investors were drawn to more attractive opportunities abroad. In addition, concerns around U.S. trade policy and tariffs benefited international markets, as non-U.S. companies were viewed as having less exposure to policy uncertainty. Emerging markets also exceeded expectations, demonstrating stronger pricing power and greater resilience than many investors had anticipated.

Within the U.S. market, artificial intelligence remained a dominant investment theme for much of the year. Communication services led all sectors with a 33.6% gain, followed by technology at 24.0% and industrials at 19.4%. Sentiment shifted in the fourth quarter, however, as growing skepticism around AI-related spending pressured technology stocks. Disappointing guidance from several large companies raised questions about the pace, scale, and ultimate profitability of significant capital investments in AI.

Small-cap stocks in the U.S. also posted solid returns, though they significantly lagged their large-cap peers. Expectations for potential Federal Reserve rate cuts provided some support, as smaller companies tend to be more sensitive to changes in borrowing costs.

Overall, 2025 was another strong year for equities, with the S&P 500 delivering double-digit gains for the third year in a row. After such robust performance, markets enter 2026 facing higher valuations and elevated expectations. Corporate earnings growth, inflation trends, developments in AI, and the Federal Reserve’s approach to interest rates will be key drivers of market performance in the year ahead.

Alternatives – Growth

Private equity markets remained active throughout 2025, with deal activity gaining momentum as the year progressed. Megadeals returned in full force, with a record 68 transactions valued at $10 billion or more announced globally during the year. The private equity holdings in client portfolios, including the Cascade Private Capital Fund, and the 2025 addition, the StepStone Private Equity Strategies Fund, continued to provide access to attractive opportunities across private markets.

These strategies benefit from purchasing existing ownership stakes at discounts and participating in co-investment opportunities alongside established managers. As public market valuations climbed to elevated levels, the diversification benefits of private equity became increasingly valuable. We expect private equity to remain an important source of long-term growth and portfolio diversification in the years ahead.

Alternatives – Income

Private credit delivered another year of steady, reliable returns in 2025. The asset class continued to generate consistent income with lower volatility than traditional fixed income. As banks pulled back further from middle-market lending, private credit managers stepped in to fill the gap, creating attractive opportunities for investors.

The fundamentals supporting private credit remain strong. Borrowers have continued to service their obligations, and loans are typically secured by tangible assets, including corporate cash flows and real estate. Higher yields, combined with lower correlation to public markets, make private credit an increasingly compelling alternative to traditional bonds, particularly in an environment where bond returns remain sensitive to inflation and Federal Reserve policy decisions.

Bonds

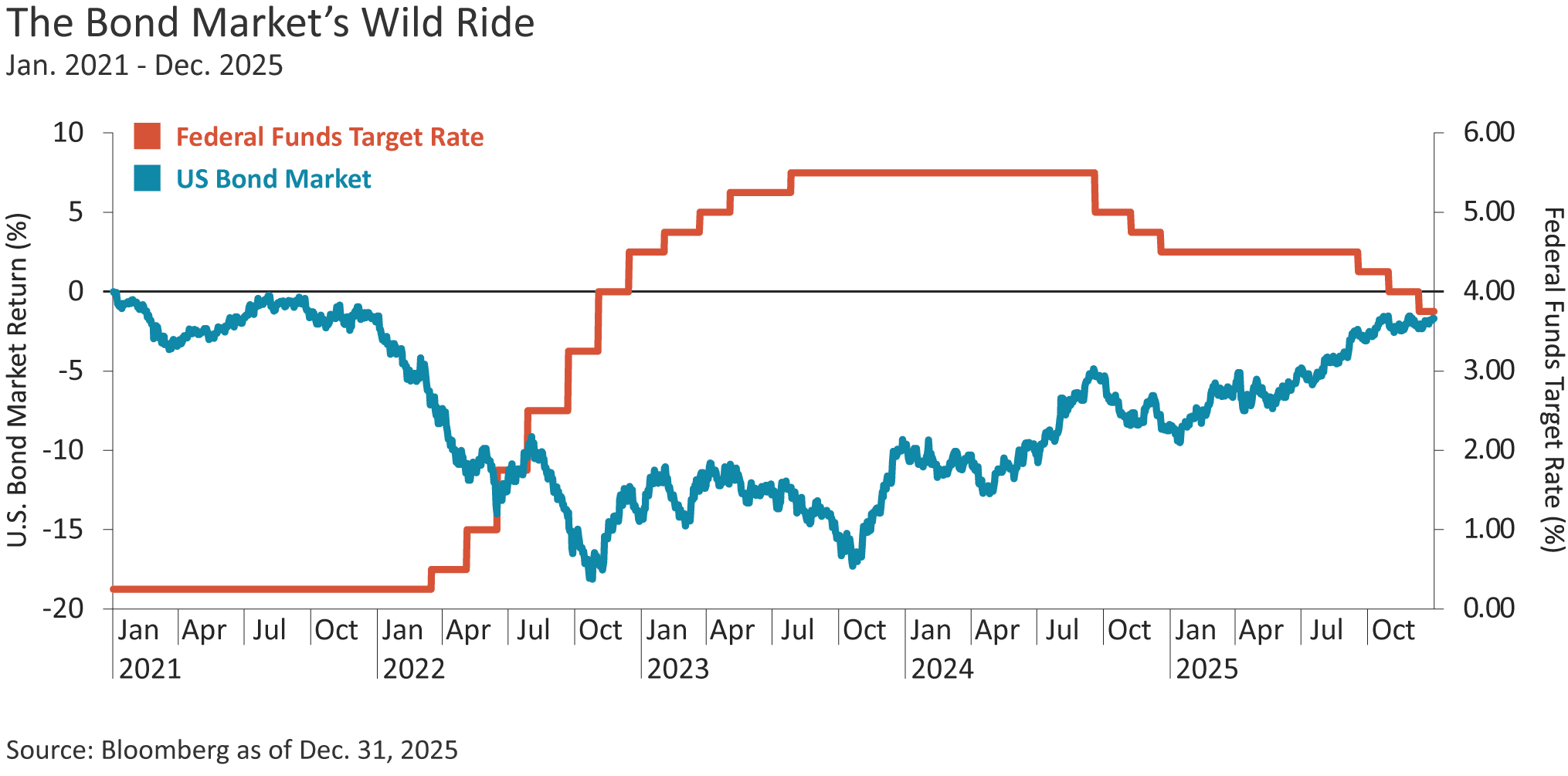

The U.S. bond market, as measured by the Bloomberg U.S. Aggregate Bond Index, delivered strong performance in 2025, gaining 7.3% for the year. The fourth quarter added another 1.1%, as the Federal Reserve continued its rate-cutting cycle. As the chart below demonstrates, the bond market’s solid performance—supported by falling interest rates in 2025—stood in sharp contrast to the challenges it faced in a rising interest rate environment, especially in 2022.

The Fed reduced rates from 4.50% at the start of the year to 3.75% by year-end, implementing three quarter-point cuts in the second half of 2025. Bond investors benefited from both the income generated by relatively high yields and bond price appreciation as interest rates declined. However, persistent inflation, which ended the year at 2.7% above the Fed’s 2% target, has led policymakers to signal a more cautious approach to additional rate cuts in 2026.

The labor market showed signs of moderation, with unemployment rising to 4.6%, yet it remains healthy by historical standards. This allowed the Fed to ease rates cautiously, balancing its dual mandate of supporting employment while keeping inflation in check.

Looking ahead to 2026, the outlook for bonds is less certain. While yields remain attractive as a source of income, the path for further rate cuts is unclear. If inflation remains elevated, the Fed may pause its easing cycle, limiting the potential for additional bond price appreciation. This environment supports our continued emphasis on shorter-maturity bonds and alternative income strategies, which can offer higher yields with less sensitivity to interest rate movements than traditional fixed income.

Recent posts

Disclosures

This content was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this content was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this content may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent.

Past performance is not indicative of future results. Investment returns will fluctuate, and investors may experience a loss. No guarantee or representation is made that any investment strategy will be successful or achieve any particular results. All investments involve risk, including the possible loss of principal. Different types of investments involve varying degrees of risk, and there is no assurance that any specific investment will be profitable.

The financial advice and recommendations that we provide are tailored to each client’s unique circumstances. Please remember to contact us if there are any material changes in your financial situation or investment objectives, or if you wish to add or modify any restrictions to your investment portfolios.

If you have any comments or questions about this content, please contact us at info@westmount.com.