Life insurance as an asset class A win-win for consumers and investors Analysis by Dimitri Krikelas, Chief Investment Officer – Private Markets

Analysis by Dimitri Krikelas, Chief Investment Officer – Private Markets

21 September 2023

Life insurance can be a great source of comfort for those looking to ensure fiscal security for their loved ones after they’re gone. But what happens when a policyholder lives a long and healthy life—well after their grown children have achieved financial autonomy and no longer need that safety net?

For these policyholders, the relentless flow of monthly premium payments can become a costly burden—especially for something that might never bear fruit. Fortunately, policyholders can recoup a substantial portion of their policies’ value by selling them to new owners. While the actual recovery amount varies from policy to policy, the average recovery amount is usually about 22% of the policy’s face amount.1

Beyond affording retirees more financial freedom in their golden years, these life settlement transactions have also created a niche investment opportunity for investors in the private markets, offering uncorrelated market exposure and greater portfolio diversification, as well as potential strong returns.

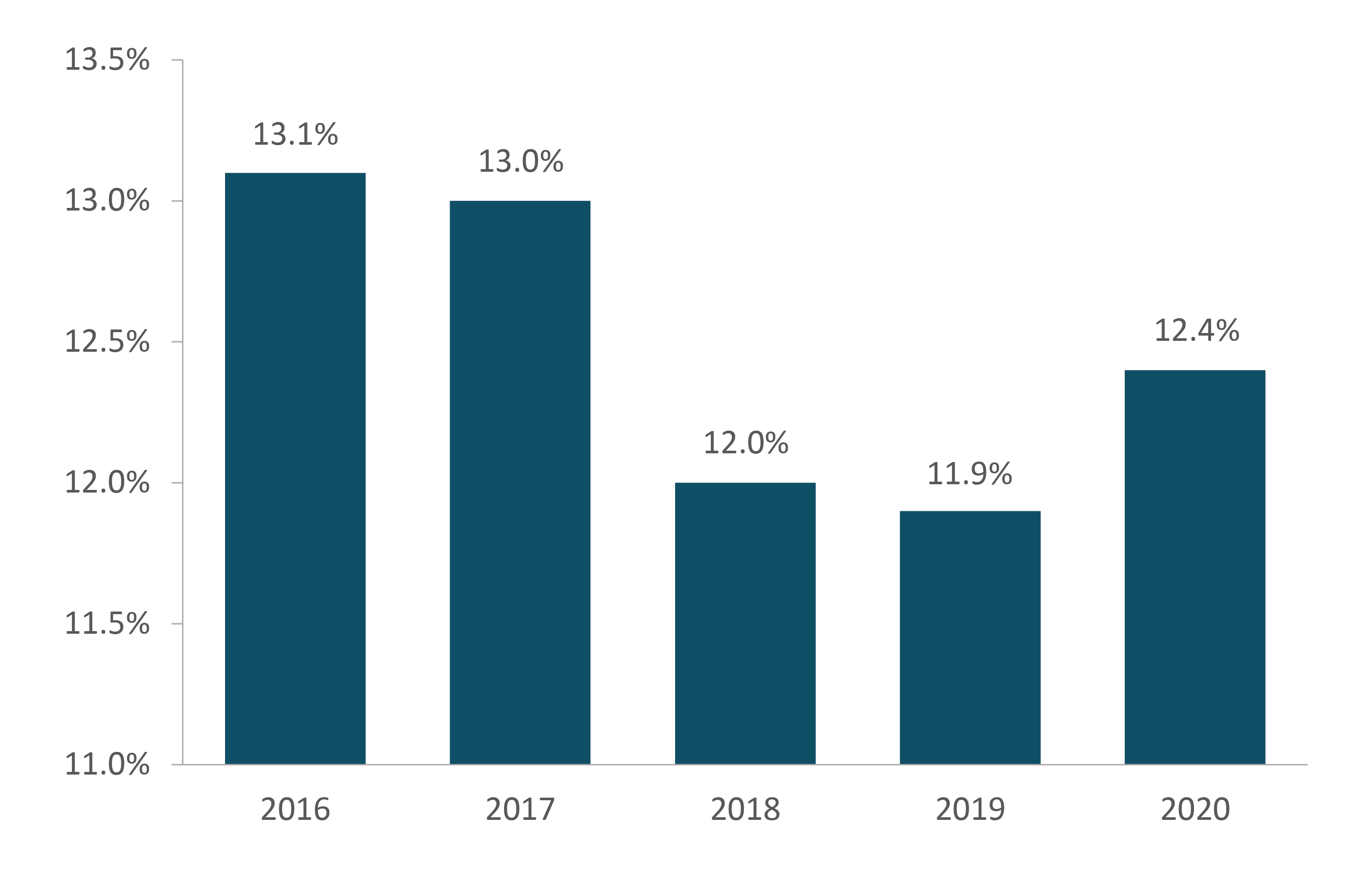

Median Investor Return

The pool of policies to choose from runs deep: a whopping 88% of universal life insurance policies either expire, lapse, or surrender before death benefits are paid out.2 What’s more, approximately $200 billion worth of unclaimed life insurance assets is projected to accumulate by 2027.3

An Under-the-Radar Opportunity

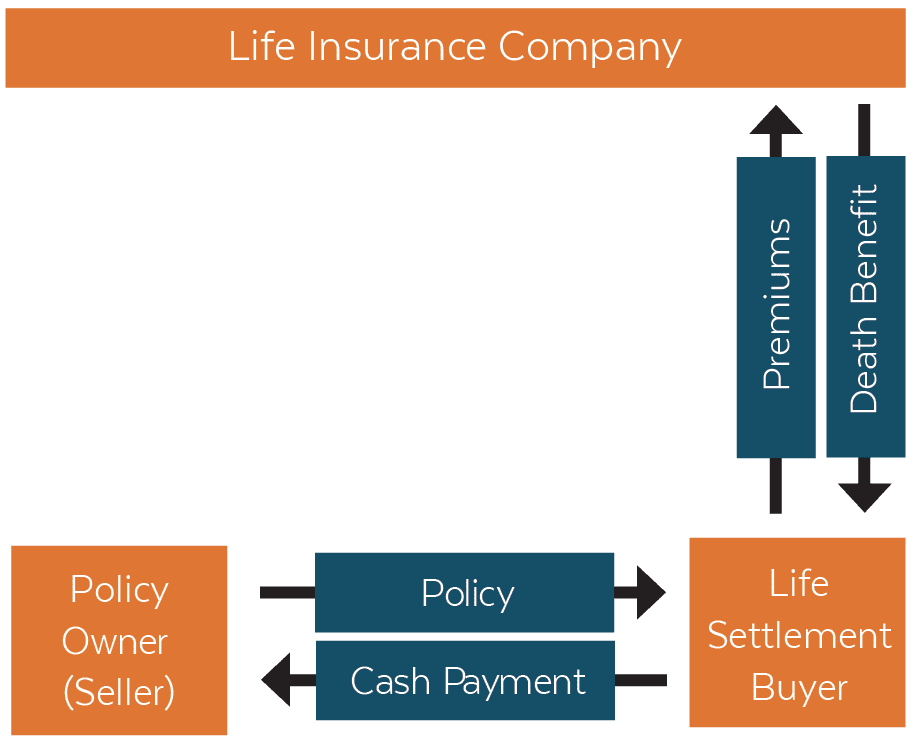

Life settlement funds are typically facilitated by managers who underwrite the sale or purchase of policies that have been transferred from one owner to another through a third party.

Such transactions have been permitted in the U.S. since 1911 following a landmark U.S. Supreme Court ruling that classified life insurance as a kind of personal property—thus enabling policyholders to transfer ownership of their policies to another party. Less surprising: insurance companies generally like to keep this option under wraps. After all, it benefits their bottom lines to collect decades of monthly premiums without ever making a payout.

There’s certainly a lack of education in this space. Most policyholders aren’t aware that their policy has worth and that there’s a market for it. Policies can potentially be sold for a higher amount than the cash surrender value, and it’s surely better than letting the policy lapse.

Yet despite the under-the-radar nature of this space, the sector has matured over time and the sheer volume of deals has risen steadily. According to one report, the life settlements industry is growing 34% per year on average6, and is projected to hit $60 billion in deals by 2025.7

The Lifecycle of Life Insurance

The life settlements market is a win-win for consumers and investors. Policyholders can liquidate their policy when they no longer need to keep the insurance in order to eliminate premium payments and receive a lump sum of cash for other uses, like pay for healthcare costs or other expenses. From the investor’s perspective, this asset class has historically generated double-digit returns in an uncorrelated nature as well as provided added diversification to a traditional portfolio.

Practicing Active Quality Control

Westmount clients can participate in this asset class through Westmount’s private investments platform. Our research approach favors managers with an established track record of creating value for both policyholders and investors. These managers employ their own teams of underwriters and analysts to derive fair values for policies that benefit both parties participating in the transaction. By managing their portfolios actively, managers not only benefit from greater diversification across age, policy size, duration, and geography, but also gain increased protection against counterparty risks.

It’s crucial to select the right strategy and manager in this asset class because there are risks. Some of the factors we look for in this asset class are experienced management teams, strong sourcing channels, high-quality carriers, and a portfolio of policies that are broadly diversified. Furthermore, while these are self-liquidating investments that are not correlated to macro events, we prefer an active approach whereby the manager can sell policies opportunistically to mitigate liquidity risks and generate alpha.

Positive Social Benefits

Another attractive aspect of this asset class are its potential social benefits. Selling an unused or unneeded policy can go a long way toward improving quality of life factors or defraying medical costs as healthcare issues arise. And if they’re still determined to give their grown children a helping hand, ex-policyholders can do so by using the proceeds to contribute to a grandchild’s college tuition or paying for assisted living facilities, skilled nursing services, and other unforeseen costs rather than saddling their children with those expenses.

There’s most definitely a socially responsible component to Life Settlements because they stem the outflow of assets and provide retirees with much-needed income.

To learn more about how we access this space for our clients, call us at 310-556-2502 or visit westmount.com/alternatives.

Recent posts

Sources

1What is a Life Settlement? – OvidLife

2,3,6Life Insurance and Life Settlement Statistics for 2023 (harborlifesettlements.com)

4Three key tailwinds behind US life settlement growth | Wealth Professional

5Bankrate | Life Insurance Claims Statistics

7The Life Settlement Market Passed the Test | ThinkAdvisor

Disclosures

Copy by Andrew Bloomenthal

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent.

Past performance does not guarantee future results, and investing in stocks, alternatives, and bonds carries the possibility of loss of principal. Securities transactions carry risk and are not suitable for all investors. Before making an investment decision, you should consider whether this information is appropriate in your circumstances. Expected returns are provided by each respective manager based on their views of the current environment. There can be no certainty that performance or events will turn out as we or the managers have opined above.

If you have any comments or questions about this report, please contact us at info@westmount.com.