Inflation (take two): Still a force to be reckoned with Inflation has reached record highs. What now? Analysis by Terrence Demorest, Chief Investment Officer - Public Markets and ESG

Analysis by Terrence Demorest, Chief Investment Officer - Public Markets and ESG

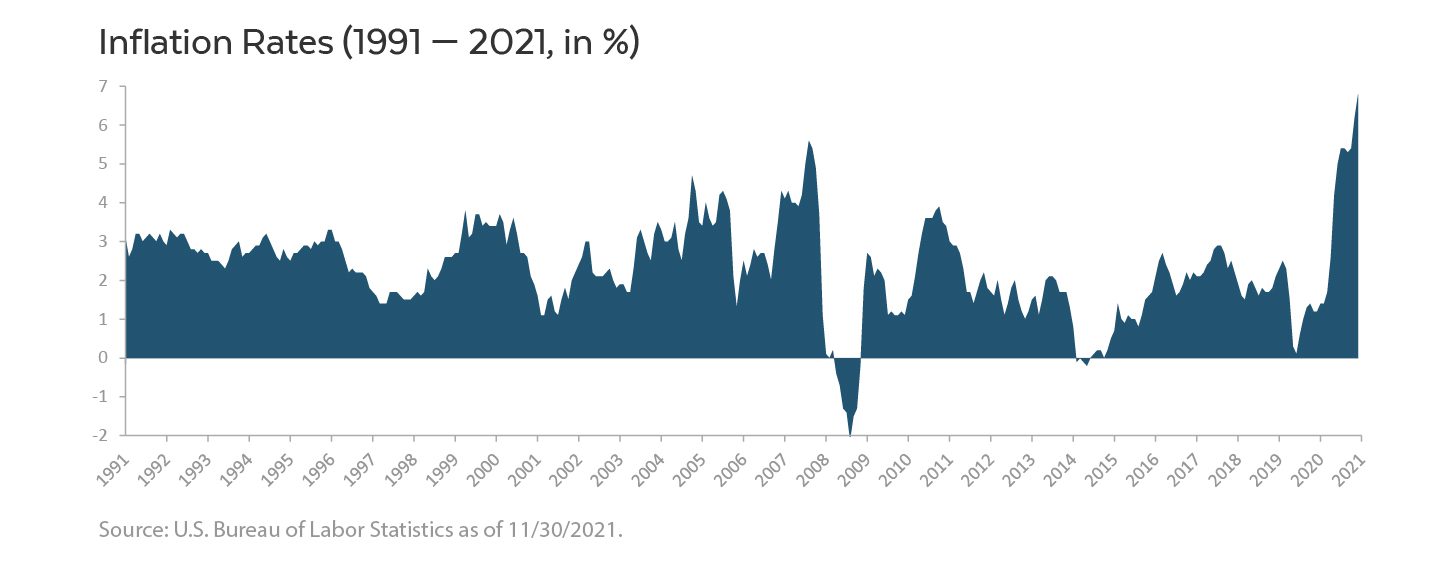

At the beginning of last year, we wrote about inflation and the likelihood that it would rise throughout 2021. As it turned out, inflation is now at its highest level in several decades. It took the Federal Reserve nearly a full year to reach the same conclusion—that the current bout of inflation is not transitory and instead is likely to persist for quite a while.

Anticipating inflationary pressures, we positioned our clients’ portfolios to thrive in this type of environment. We renewed our conviction in owning globally diversified stocks with a heavy tilt toward large-cap U.S. companies. We increased our exposure to private credit, which significantly boosted the yield of the portfolio and overweighted floating rate loans. We avoided longer-term bonds by investing in shorter-dated maturities, which have much less interest rate sensitivity and hence less exposure to principal erosion when interest rates rise.

Looking ahead, as inflation continues to persist, expect portfolios to maintain this type of positioning.

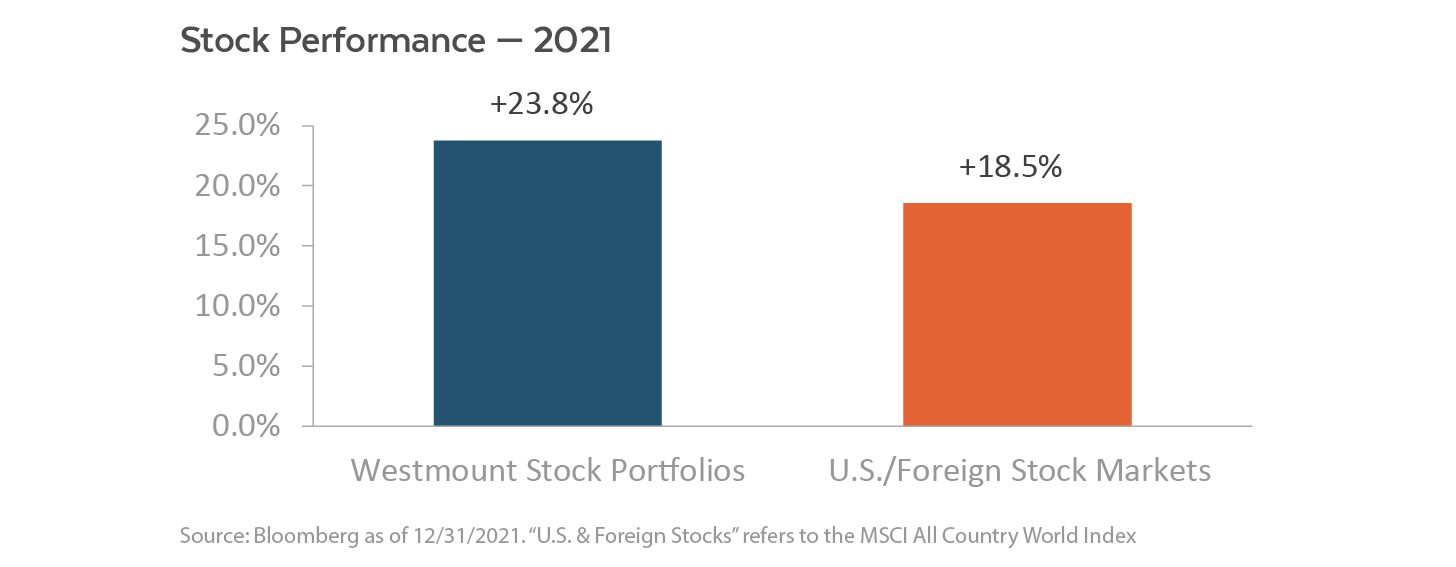

Stocks in 2021: Profiting Heavily From Having Market Exposure

2021 was a terrific year to own stocks, particularly within the large-cap U.S. company space where our portfolios are most heavily weighted. International developed stocks lagged domestic markets but still produced solid overall returns. While valuations finished the year on the higher side and volatility, while present, was inconsistent through the year, we feel that stocks will continue to be a critical component for long-term growth in client portfolios (notwithstanding the inevitable periods of short-term volatility and declines).

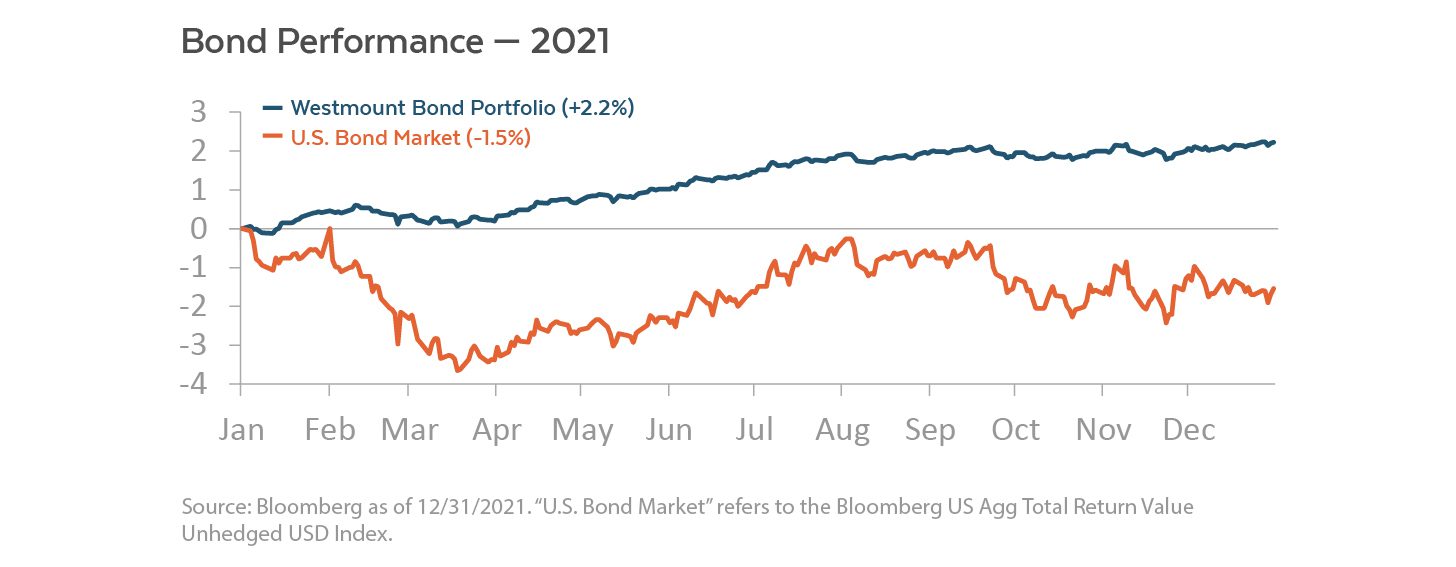

Bonds in 2021: Positive Returns from Not Owning the Market

While stocks soared in 2021, the bond market fared terribly. Interest rates started the year near all-time lows and, as we expected, interest rates began to climb. For the traditional bond market this meant depressed bond prices under the backdrop of continuing low yields and negative returns. In sharp contrast, our clients’ bond portfolios took selective credit risk that generated higher yields while at the same time maintained low interest rate sensitivity, which kept our bonds mostly immune to the rising interest rate environment. Overall, this led to positive (though modest) returns in our bond portfolios.

Alternatives in 2021: Private Credit is the Silent Star

The private credit market is a segment of the financial markets that has received very little attention from the financial press and the investment world but has consistently delivered strong risk-adjusted returns. Typically, these are private loans to corporations and real estate operators that are collateralized by assets and real estate. Because they are loans, the end-investor takes on significantly less risk than owning stocks while at the same time receiving much higher income and appreciation potential than owning traditional bonds.

Private Credit Funds in Westmount’s Portfolios (2021 return):

- Variant Alternative Income Fund: +12.29%

- Cliffwater Corporate Lending Fund: +10.38%

For the past two years we have been increasing this exposure primarily through two funds, the Variant Alternative Income Fund and Cliffwater Corporate Lending Fund.

Recent posts

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission. The information contained in this article was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this article may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent.

The performance figures for the representative WAM Moderate Balanced portfolio are derived from the composite performance of the stock, alternatives, and bond portions of all fully-invested client accounts. The actual performance and allocation of individual client accounts will vary. Performance figures include the reinvestment of dividends. Westmount’s fees are described in Part 2 of our Form ADV, which is available upon request.

Past performance is no guarantee of future results, and investing in stocks, alternatives, and bonds carries the possibility of loss of principal. The various market indices and representative portfolios on the chart are provided to assist clients in evaluating Westmount’s performance relative to the markets in which we invest. Westmount’s portfolios are not intended to perfectly mirror the relevant indices, may have more or less volatility than the indices, and may invest in markets and strategies not represented by any of the indices shown. The indices are unmanaged and do not carry fees or expenses.

If you have any comments or questions about this article, please contact us at info@westmount.com.