Private credit: a potential hedge against inflation Tap the potential for lower volatility and higher returns. Analysis by Dimitri Krikelas, Chief Investment Officer – Private Markets

Analysis by Dimitri Krikelas, Chief Investment Officer – Private Markets

If you’re a small business owner, you know that it’s harder to raise capital than it used to be thanks to the post-2008 regulatory crackdown coupled with COVID-19-era bank loan restrictions. The resulting environment has left capital-strained small-and-medium enterprises (SMEs) in a tough spot, where they struggle to source funding for expansion, corporate acquisitions, and purchase order fulfillment but are reluctant to dilute ownership by selling stock to equity investors.

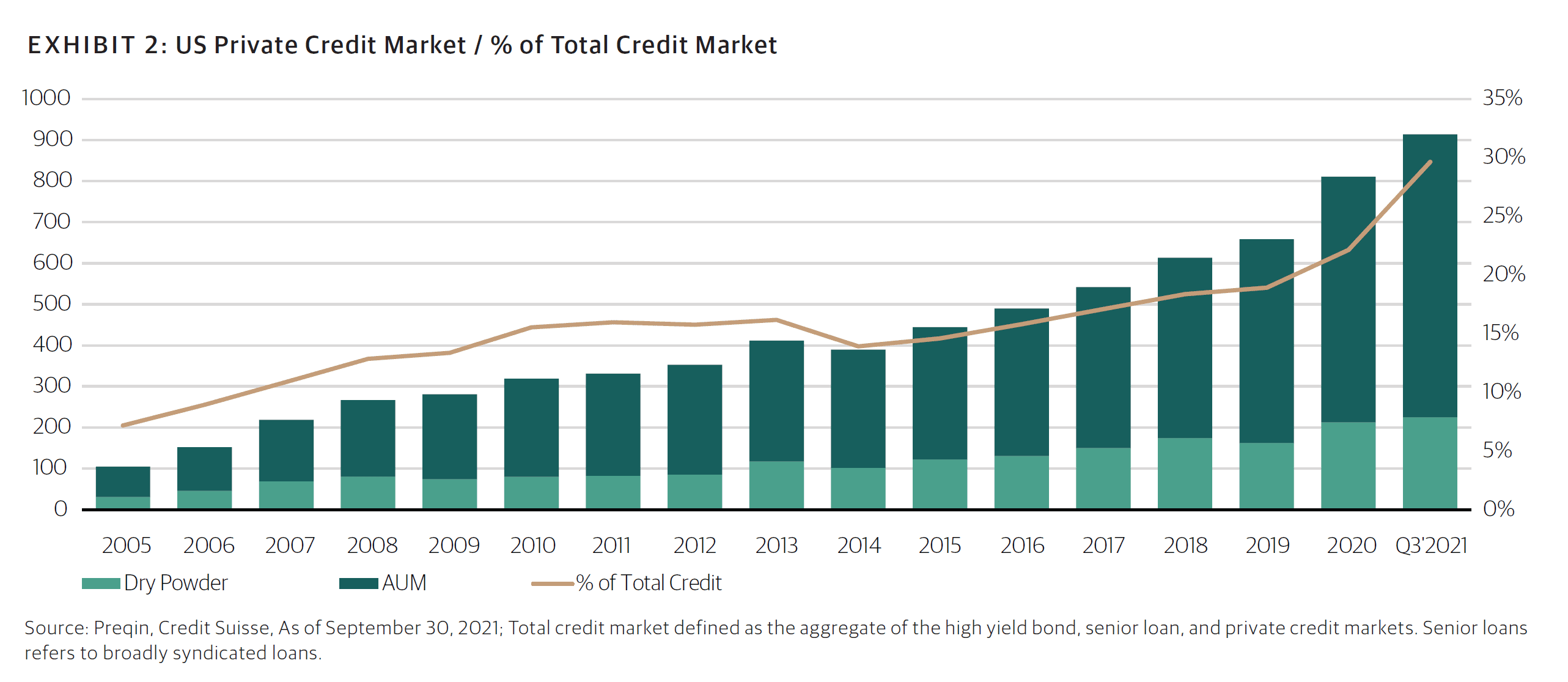

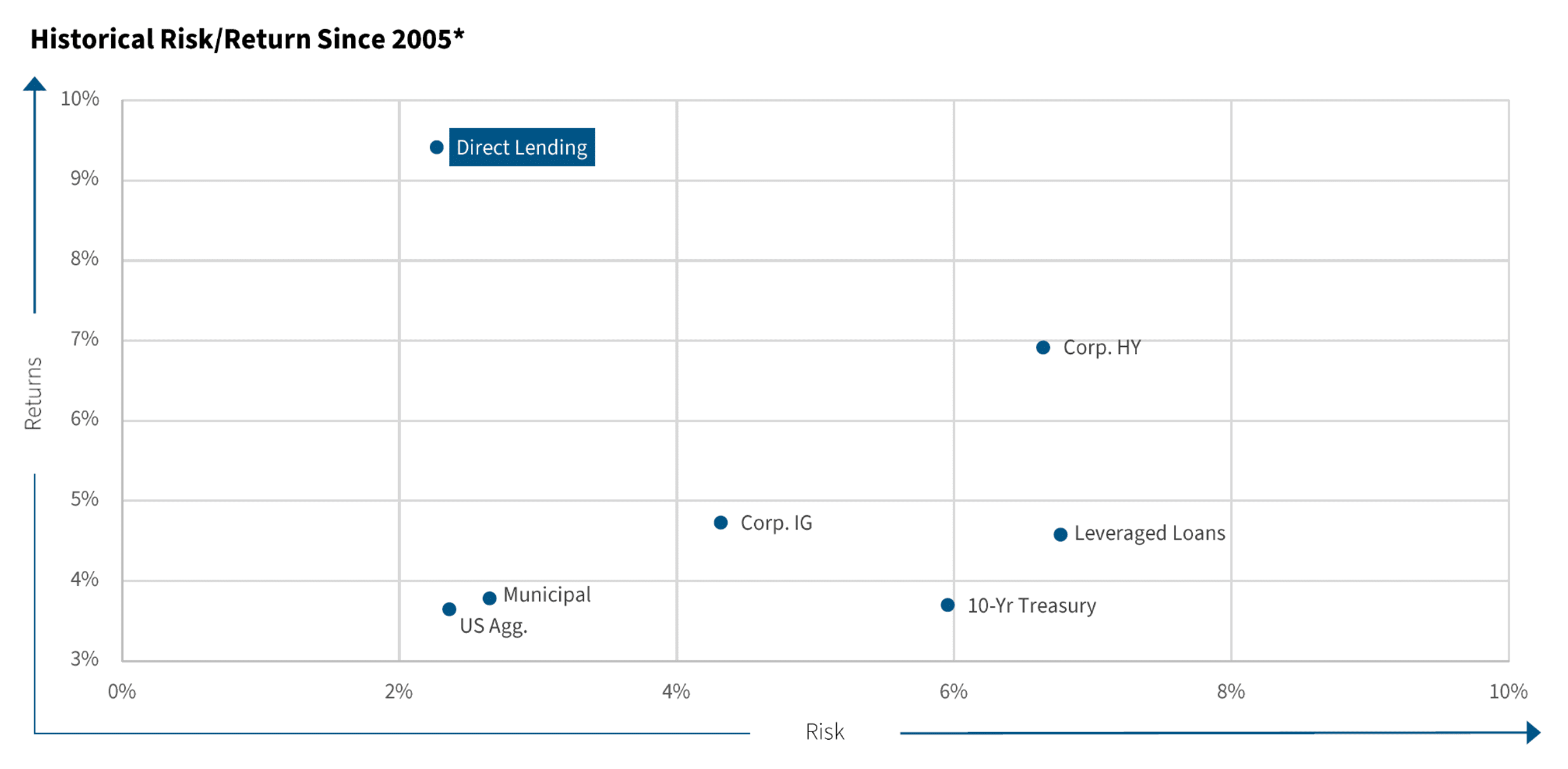

As a result, investments in private credit securities—sometimes also referred to as “direct lending” or “private lending”—have been on a historic climb. Once viewed as a niche market, today’s private credit asset class offers investors a compelling way to enhance returns by introducing uncorrelated market exposure to their traditional portfolios. Defined as non-bank issued, privately negotiated loans that are unavailable for trade on any open market, private credit investments boast increased likelihood of capital preservation and higher risk-adjusted returns compared to traditional bank-originated debt products. Case in point: private loans typically see returns in the neighborhood of 8%-9%1, surpassing the returns of public bonds. Importantly, private debt is inherently less volatile thanks to covenants and collateralization that is typically negotiated into the deals.

The pool of potential borrowers runs deep. Typically ranging from $3 million – $100 million in EBITDA2 and therefore too small to access the public markets, these businesses are key drivers of the private loan landscape, comprising more than 30% of the total US credit market.3 What’s more: the surge in private credit deals is global, with emerging/developing markets experiencing the most significant spike in private investments ($10.8 billion in 2022—a whopping 89% jump from the year before).4

Source: Blackstone5

When a middle market company needs money for anything—from corporate finance and growth capital to equipment leases—they look to the private markets for that capital. Generally speaking, companies are more willing to pay a higher interest rate for a short-term loan rather than sell equity to a private equity firm and give up a board seat. And by the way, that interest is tax-deductible, so the real cost of the debt is much less than the 9% interest.

Customizable Solutions

By their very nature, private credit deals boast flexible contract designs—a fact that puts investors in the proverbial driver’s seat. First and foremost, investors enjoy higher yields than public bonds because the rates are privately negotiated based on a company’s underlying value and not an interpretation of its value. Secondly, private deals regularly feature lower loan-to-value (LTV) ratios, which further feed into the lower risk profile associated with this asset class. And the use of covenants, where companies must either fulfill certain obligations or abstain from certain activities throughout the life of the loan, offers yet another measure of quality control.

First in Line

In case of a bankruptcy or other liquidation event, private credit investors enjoy senior status (if structured as senior in the capital stack), giving them priority to claim assets. This offers them more downside protection than investors in asset classes like subordinated debt, mezzanine debt, preferred equity, or equity. Of course, an investor’s position on the capital stack must be privately negotiated at the onset, with each investment.

We find this asset class attractive because, besides offering higher yields, there is strong collateral behind these assets, and private loans have historically had a higher recovery rate compared to public corporate bonds, which translates to lower volatility.

Data: Dec. 31, 2004, to March 31, 2022. Past performance is not a guarantee of future results. There can be no assurance that historical trends will continue during the life of any fund. Sources: Bloomberg; Cliffwater Direct Lending Index (“CDLI”). Benchmarks: Cliffwater Direct Lending Index, S&P/LSTA Leveraged Loan Index, Bloomberg US Aggregate Bond Index, Bloomberg US Municipal Index, Bloomberg US Corporate Bond Index, Bloomberg US Corporate High Yield Index. Risk measured as standard deviation of quarterly returns. Indices are not actively managed and investors cannot invest directly in the indices.

Hedging Inflation

During periods of inflation, off-market lending can be used to enhance the investors’ ability to control duration or the measure of a bond’s price sensitivity to a change in interest rates. But unlike public debt, private credit offers additional premiums that result in higher spreads and decreased volatility. Even more importantly, many private debt investments feature floating rates that act as buffers against further rising interest rates. In other words, floating debt that is benchmarked to the London Interbank Offered Rate (LIBOR) or more recently, the Secured Overnight Financing Rate (SOFR), is likely to benefit by paying higher yields as the central banking system raises rates in an effort to combat inflation.

When you factor in pent-up consumer demand exacerbated by supply chain issues, as well as price swings related to the war in Ukraine, inflationary pressures are a concern right now for investors. You need only to look at the recent economic climate to see how private debt functions as an inflation hedge to the benefit of investors. In the last six months, inflation has been ripping, base rates have been increasing at the Fed level, and floating-rate securities are constantly repricing off of that.

A Rigorous Vetting Process

To source private credit opportunities for investors, Westmount cultivates relationships with a deep bench of private lenders that have demonstrable track records, in-depth industry knowledge, and a solid network of connections to help them source loans. This lets investors tap into a well-diversified basket of loans across sectors like infrastructure, healthcare, technology, and commercial real estate. Managers likewise structure loans with staggered amortization schedules that keep the income flowing. As the principal on a loan is paid down and the interest gets paid back, investors incrementally pocket returns, typically on a quarterly basis, without the worry of a single defaulting borrower tarnishing the overall return prospects.

While defaults are sometimes unavoidable in this space as managers build portfolios with hundreds or even thousands of counterparties, their ability to manage loss ratios between zero and 2% creates stable cash flows from a diversified set of borrowers. Furthermore, funds from the repaid loans can be continuously reallocated—putting the cash to work over the long haul.

For these reasons, the lenders Westmount partner with present investors with well-diversified, uncorrelated exposure to complement their public debt positions.

Learn more

To learn more about how we access this space for our clients, call us at 310-556-2502 or visit westmount.com/alternatives.

Recent posts

Sources

1,3,5 Private Credit’s Rapid Growth: A Secular Trend (PDF)

2,6,7 Private Debt Gaining Traction as an Asset Class

4 McKinsey’s Private Markets Annual Review

8 2022 Preqin Global Private Debt Report

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent.

Past performance does not guarantee future results, and investing in stocks, alternatives, and bonds carries the possibility of loss of principal. Securities transactions carry risk and are not suitable for all investors. Before making an investment decision, you should consider whether this information is appropriate in your circumstances. Expected returns are provided by each respective manager based on their views of the current environment. There can be no certainty that performance or events will turn out as we or the managers have opined above.

If you have any comments or questions about this report, please contact us at info@westmount.com.