Cell phone towers: can you hear me now? The next generation of communications infrastructure Interview with Dimitri Krikelas, Chief Investment Officer – Private Markets

Interview with Dimitri Krikelas, Chief Investment Officer – Private Markets

10 November 2023

American consumers exchanged two trillion text messages in 2021 and spent a whopping 2.4 trillion minutes talking to each other on their cell phones.1 What’s more, it’s projected that 1.3 billion people will access the internet solely through their smartphones by 2025.2

With more users watching their screens, instant gratification is no longer an option—it’s a must-have that’s resulted in significant infrastructure spending and upgrades to enable the next generation of wireless networks.

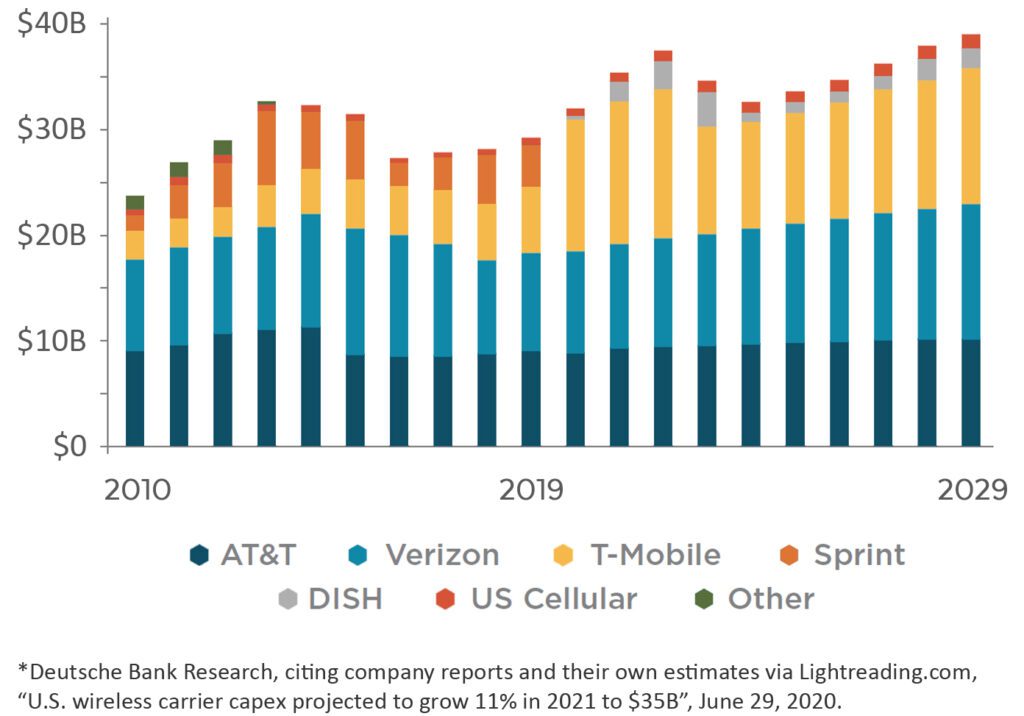

“The major cell phone carriers understand this need for faster speeds and are spending tens of billions of dollars each year to upgrade their infrastructure and networks,”3 says Dimitri Krikelas, Westmount’s Chief Investment Officer for Private Markets. “Besides ushering in the 5G era for consumers, these improvements are creating compelling, niche real estate investment opportunities for investors.”

A distinct asset class

Cell phone towers boast distinct advantages over other asset classes in the space. Chief among them: maintenance is cheap and easy once the towers are up and running. After the initial acquisition, tenants are responsible for mounting and maintaining antennas, radio transmitters, and other communications equipment, making it a high-margin business for the owner. As long as tower owners mow the grass, maintain the exteriors, keep security fences standing, and provide power to the premises, rental incomes will flow.

Not surprisingly, long-term tower rental leases are in high demand among both big-name providers like AT&T, Verizon, and T-Mobile, as well as smaller rural and regional players. Leases are typically for a base of 10 years with multiple five-year renewal periods, meaning owners can lock in stable cash flows

for 25 years or more with high credit quality counterparties.

This holds true even during shaky economic periods like the COVID-19 pandemic, when cell phone tower owners enjoyed 100% rent collection and 96% lease renewal rates.4

Annual U.S. wireless infrastructure spending*

What’s more, those contracts frequently featured built-in rent escalators to hedge against inflation, in the neighborhood of 3% annually.5 Another element that benefits lessors is the ability to renegotiate lease terms when providers upgrade their hardware. For example, many providers are currently equipping their towers to support 5G networks, which requires bulkier equipment and opens the door for owners to capture higher lease rates.

Although the need for increased virtual connectivity may be a naturally expected byproduct of the quarantine, COVID was arguably a mere catalyst for growth that was already occurring.

“At the end of the day, this is a story about service. There has been and continues to be a lot of pressure on carriers to invest in infrastructure and expand their coverage maps,” says Krikelas. “And when we talk about ‘infrastructure,’ we’re not just talking about towers: fiber networks and data centers are crucial too, especially when you think about the future of connectivity and the role that data-dependent technologies like artificial intelligence and autonomous vehicles will play.”

High occupancy rate

The vast majority of cell towers can accommodate up to four tenants each, typically comprising wholly different companies to ensure each tower rents to capacity. But this wasn’t always the case. Decades ago, carriers self-financed towers strictly for their own usage. But this model presented cash flow issues for providers, who weren’t always able to maximize the use of their own infrastructure.

“This essentially forced carriers to become hard real estate owners, which is a business they never really wanted to be in,” says Krikelas. “It made much more sense for third-party tower owners to build cash-generating assets for high credit-quality tenants and leave the coverage map strategies to the carriers.”

Opportunity set

Westmount’s investment platform brings investors exposure to the cell phone tower asset class using private partnerships structured as Real Estate Investment Trusts (REITs), which aggregate multiple cell tower structures to diversify exposure and reduce portfolio risk. This involves expanding assets beyond the standard stick-in-the-ground macro towers to include rooftop easements, small cells, and distributed antenna systems.

By far, though, the proliferation of new cell phone towers represents the greatest opportunity set for investors, especially in the wake of the ongoing 5G network rollout, which is expected to claim 25% of the worldwide mobile market by 2025.6 Since 5G bands are shorter, carriers must occupy more towers to fill out their coverage areas than would have been required under the previous 4G regime.

There are other reasons, too. For example, mobile connectivity behaves similarly to non-cyclical consumer staples like soap and toothpaste. These are all items we compulsively must access, whether during good fiscal times or bad.

Furthermore, growing demand for private networks is triggering the emergence of a new, unanticipated group of tenants that are eager to build their capabilities to aggressively capture market share. Private 5G networks are likely to spawn a fourth Industrial Revolution in manufacturing processes. Companies that invest and plan for private 5G networks will be able to operate with extreme flexibility and create agile, real-time ecosystems for suppliers, customers and asset management.

“These assets are operationally mission-critical to tenants’ businesses,” says Krikelas. “And for investors, it’s a great space to be in considering historical returns have been in the low- to mid-teens range per annum with 5-6% in tax-deferred annual cash flow. It’s a stable, noncorrelated asset class. That’s why we find it so exciting.”

Taking the next step

Private market assets typically carry high investment minimums and require of investors the right set of relationships, sourcing channels, and due diligence capabilities.

To learn more about how we access this space for our clients, call us at 310-556-2502 or visit westmount.com/alternatives.

Recent posts

Sources

1CTIA: U.S. Wireless Investment Hits Record High

2Zippia: “20 Vital Smartphone Usage Statistics [2022]: Facts, Data, and Trends On Mobile Use In The U.S.”

3Deutsche Bank Research, citing company reports and their own estimates via Lightreading.com, “U.S. Wireless Carrier Capex Projected to Grow 11% in 2021 to $35B”

4Hoya Capital: “REITs – This Time It Was Different.” Rent collection data for those reporting companies is provided for educational purposes only. There is no guarantee that these trends will continue for all companies. This limited data point may or may not be reflective for other companies and no inference should be made regarding its applicability to the Offering. Information is for this time period only and may not be indicative of other time periods.

5Dtgla Infra: Cell Tower Lease (Rates, Agreements, Buyout, Value)

6Statista: Mobile Technology Share By Generation 2016-2025

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent.

Past performance does not guarantee future results, and investing in stocks, alternatives, and bonds carries the possibility of loss of principal. Securities transactions carry risk and are not suitable for all investors. Before making an investment decision, you should consider whether this information is appropriate in your circumstances. Expected returns are provided by each respective manager based on their views of the current environment. There can be no certainty that performance or events will turn out as we or the managers have opined above.

If you have any comments or questions about this report, please contact us at info@westmount.com.