Investment opportunities in affordable housing Bring on home reliable returns and tax advantages. Analysis by Dimitri Krikelas, Chief Investment Officer – Private Markets

Analysis by Dimitri Krikelas, Chief Investment Officer – Private Markets

7 January 2022

According to the U.S. Department of Housing and Urban Development (HUD), rental prices have been outpacing income growth since 2000, while the number of renters has risen steadily since the Great Recession.1 Today, there are approximately 44 million renter households in the U.S.; of those households, roughly 10.8 million qualify for federal subsidies, programs, and benefits.2 The COVID-19 outbreak and subsequent government response have only intensified this demand by putting more financial pressure on renters, and especially low-income workers, who have struggled to keep up with rent payments.

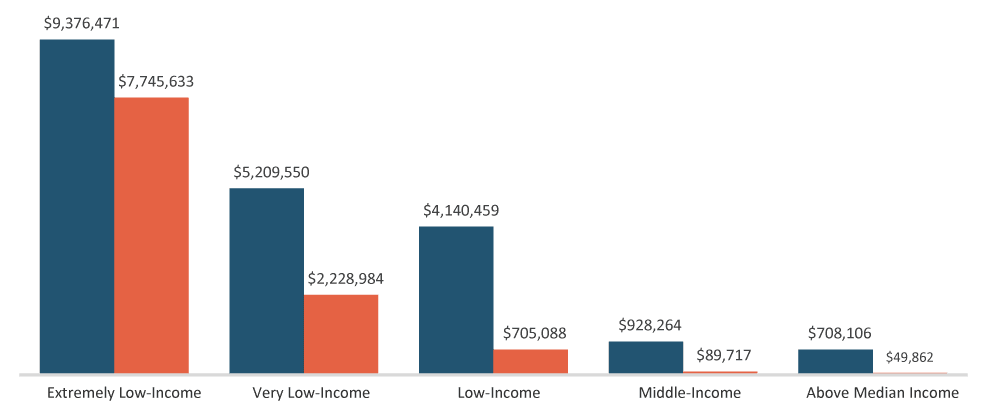

Despite skyrocketing demand for affordable units, supply remains constrained. For every 100 low-income renter households, the National Low Income Housing Coalition (NLIHC) estimates there are only about 37 affordable rental homes available.3 Put another way, the U.S. is facing an affordable housing shortage of roughly 6.8 million units.4

Contributing to this shortage is the general inefficiency of the affordable housing market itself. Participation requires specialized knowledge of the various regulations and subsidy programs specific to affordable housing properties. Consequently, the need for such specialization has made it difficult to source adequate capital for new construction projects and sorely needed renovations.

Source: NLIHC tabulations of 2019 ACS PUMS data

In our view, such overwhelming long-term demand, coupled with constrained supply, have generated a rich investment universe in the affordable housing space. Skilled investors can benefit from this environment by partnering with capital providers who have the requisite combination of knowledge, connections, and expertise. We examine why and how below.

Finding Equity- and Debt-Based Deals

Within the affordable housing space, knowledgeable capital providers can identify and invest in the best-positioned markets, property types, and capital structures. Opportunities span both equity and debt-based deals, including loans secured by affordable housing properties or direct acquisition and improvement of properties themselves.

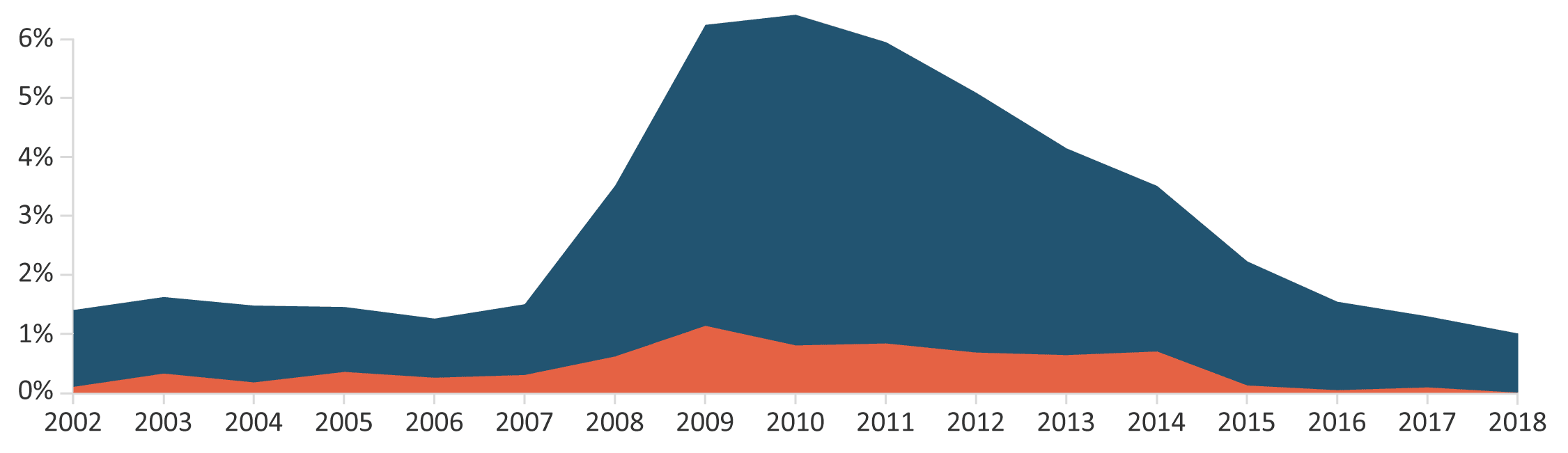

Source: CohnReznick LLP, “Housing Tax Credit Investments: Investment and Operational Performance 2019 Report

On the debt side, lenders typically generate interest by originating short-to-medium-term loans, often in the form of first mortgage or bridge loans, to finance acquisition and renovation of existing multi-family properties.

On the equity side, investors use capital improvements, rent arbitrage, cost control, operational improvements and occupancy growth processes to add value to acquired properties. Rent increases can be pre-negotiated with local and federal housing authorities eliminating rental rate risk and lease up risk. In both cases, compelling investment opportunities can be identified and implemented through highly specialized networks and underwriting expertise, as well as knowledge of complex subsidy programs and key players in the space.

From a portfolio perspective, returns on affordable housing investments are attractive because affordable units tend to have reliable occupancy rates, even in recessionary environments, which generate compelling returns that are non-correlated with other asset classes. In addition, the short-term (or floating-rate) nature of affordable housing loans provides protection from exposure to rising interest rates, and government programs supporting rent payments and/or providing liquidity for refinancing capital further reduces downside exposure.

Moreover, returns on many affordable housing-related strategies offer potential tax benefits in the form of deferrals due to depreciation/improvements and/or favorable tax treatment of REIT structures. Furthermore, takeout financing provided by government-sponsored entities represents a reliable source of liquidity at exit. Lastly, affordable housing investments often generate a measurable social/environmental benefit by enabling renovations that improve water conservation and energy efficiency, and reduce waste, among other social benefits.

While we see a broad opportunity set in the affordable housing space, identifying the right investments requires thorough research, due diligence, and a solid understanding of government regulations and subsidy programs. Through our decades of experience, Westmount has built a diverse network of high-quality private lenders that specialize in these markets. By investing with these lenders, often through private funds structured as limited partnerships, Westmount clients can access these opportunities with the benefit of professional, institutional-class investment managers.

Learn more

To learn more about how we access this space for our clients, call us at 310-556-2502 or visit westmount.com/alternatives.

Recent posts

Sources

1U.S. Dept. of Housing and Urban Development: https://www.huduser.gov/portal/pdredge/pdr-edge-trending-110716.html

2,4National Low Income Housing Coalition: https://reports.nlihc.org/gap/about

3National Low Income Housing Coalition: https://reports.nlihc.org/gap

Disclosures

This report was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this report was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions, and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal, or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this report may be copied in any form, by any means, or redistributed, published, circulated, or commercially exploited in any manner without Westmount’s prior written consent.

Past performance does not guarantee future results, and investing in stocks, alternatives, and bonds carries the possibility of loss of principal. Securities transactions carry risk and are not suitable for all investors. Before making an investment decision, you should consider whether this information is appropriate in your circumstances. Expected returns are provided by each respective manager based on their views of the current environment. There can be no certainty that performance or events will turn out as we or the managers have opined above.

If you have any comments or questions about this report, please contact us at info@westmount.com.