Revisiting cash in an environment of falling interest rates Analysis by Scott Fellmeth, Partner and Head of Family Office Services

Analysis by Scott Fellmeth, Partner and Head of Family Office Services

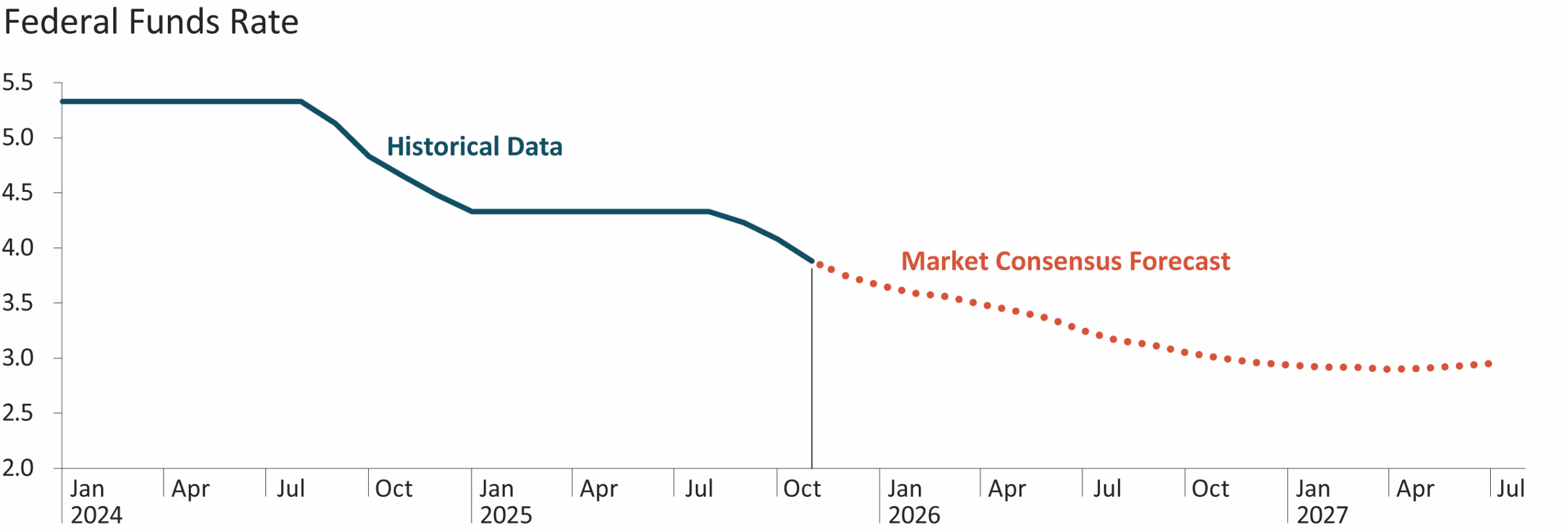

A little over a year ago, we wrote a note to clients advising them to deploy cash that had not been earmarked for current use into other vehicles that we felt would do better in a lower interest rate environment, such as fixed-rate bonds and private credit. Since then, the Federal Reserve has cut rates several times, with the Fed itself predicting even more cuts well into 2026.

As we did a year ago, we encourage clients to review their cash and money market holdings to see if those funds could be more effectively deployed elsewhere. Acting pre-emptively can preserve today’s still-attractive rates by locking in yields for longer periods of time (through purchasing fixed-rate bonds).

In the event of market volatility, it is reasonable to assume that rates could drop rapidly, which would increase the value of investment-grade bonds (which comprise a large portion of our bond portfolio) and provide a timely hedge against potential stock market losses. Additionally, private credit, which carries higher yields at the cost of limited liquidity, can be an attractive solution for cash that does not need to be deployed in the near future.

Whether you’re looking to preserve yield, increase returns, or hedge portfolio volatility, the time to move from cash to bonds is before rates drop. As such we encourage you to consult with your Westmount advisor on whether your cash can be more effectively deployed today.

Recent posts

Sources

Chart source: econforecasting.com.

Disclosures

This content was prepared by Westmount Partners, LLC (“Westmount”). Westmount is registered as an investment advisor with the U.S. Securities and Exchange Commission, and such registration does not imply any special skill or training. The information contained in this content was prepared using sources that Westmount believes are reliable, but Westmount does not guarantee its accuracy. The information reflects subjective judgments, assumptions and Westmount’s opinion on the date made and may change without notice. Westmount undertakes no obligation to update this information. It is for information purposes only and should not be used or construed as investment, legal or tax advice, nor as an offer to sell or a solicitation of an offer to buy any security. No part of this content may be copied in any form, by any means, or redistributed, published, circulated or commercially exploited in any manner without Westmount’s prior written consent.

The “Federal Funds Rate” chart provides monthly data & forecasts of the U.S. federal funds rate, the short-term interbank lending rate for cash held at the Federal Reserve. The federal funds rate is a critical benchmark rate in the global economy, and is the primary rate targeted by the Federal Reserve in monetary policy interventions. It is considered a risk-free rate and is frequently used as a proxy of the riskless cost of borrowing in the U.S. economy.

The market consensus forecast is a daily-updated forecast of key benchmark interest rates. It is generated primarily using yield data and futures market prices, using minimal econometric assumptions. Forecasts from the model can be interpreted as the median expectation of market participants. The federal funds rate component of the forecast is directly extracted from futures market prices with a model-derived term premium.

The financial advice and recommendations that we provide are tailored to each client’s unique circumstances. Please remember to contact us if there are any material changes in your financial situation or investment objectives, or if you wish to add or modify any restrictions to your investment portfolios.

If you have any comments or questions about this content, please contact us at info@westmount.com.